Question: 8. (Complexico mine 0) Consider the Complexico mine and assume a 10% constant interest rate; also assume the price of gold is constant at $400/oz.

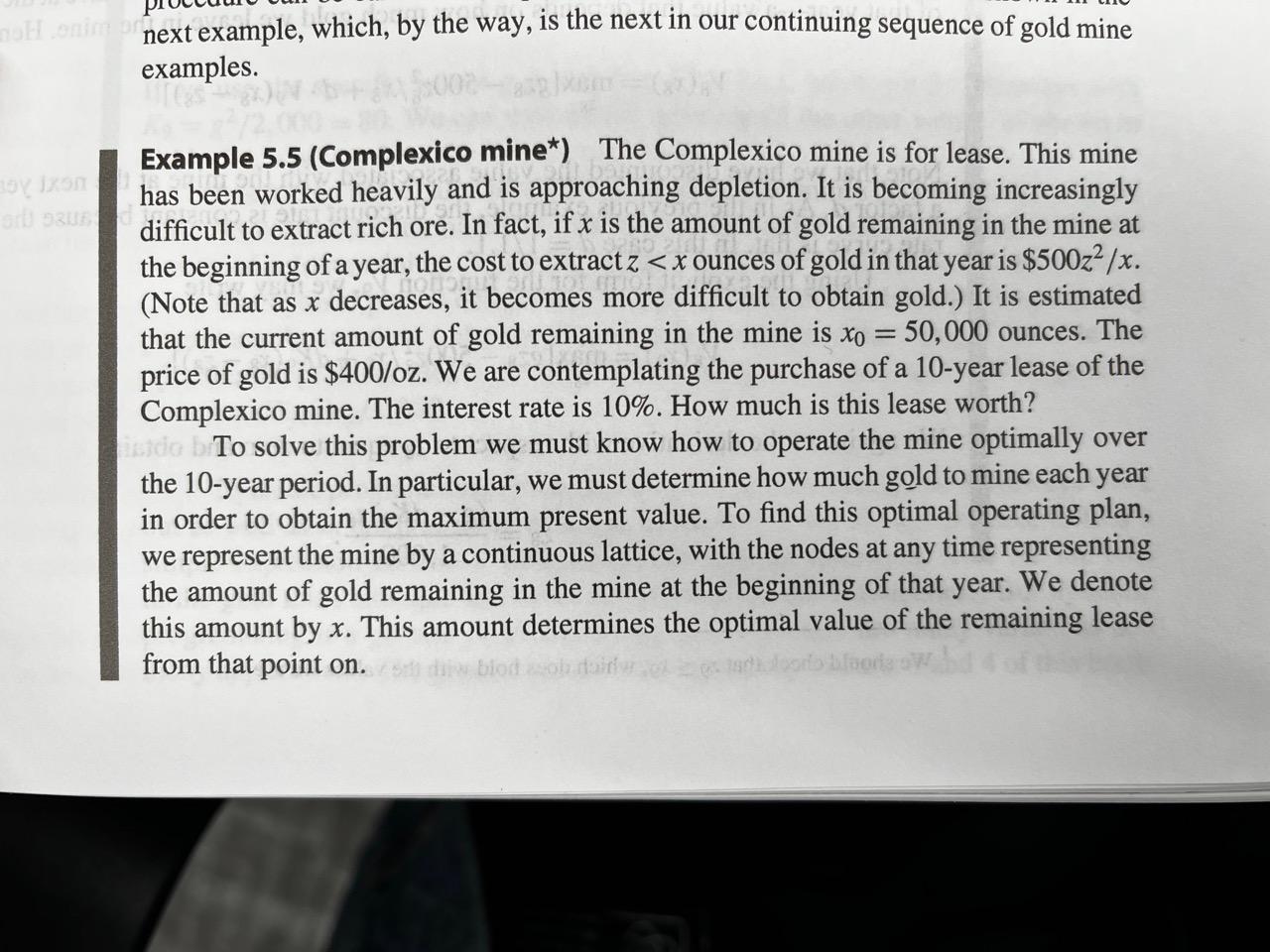

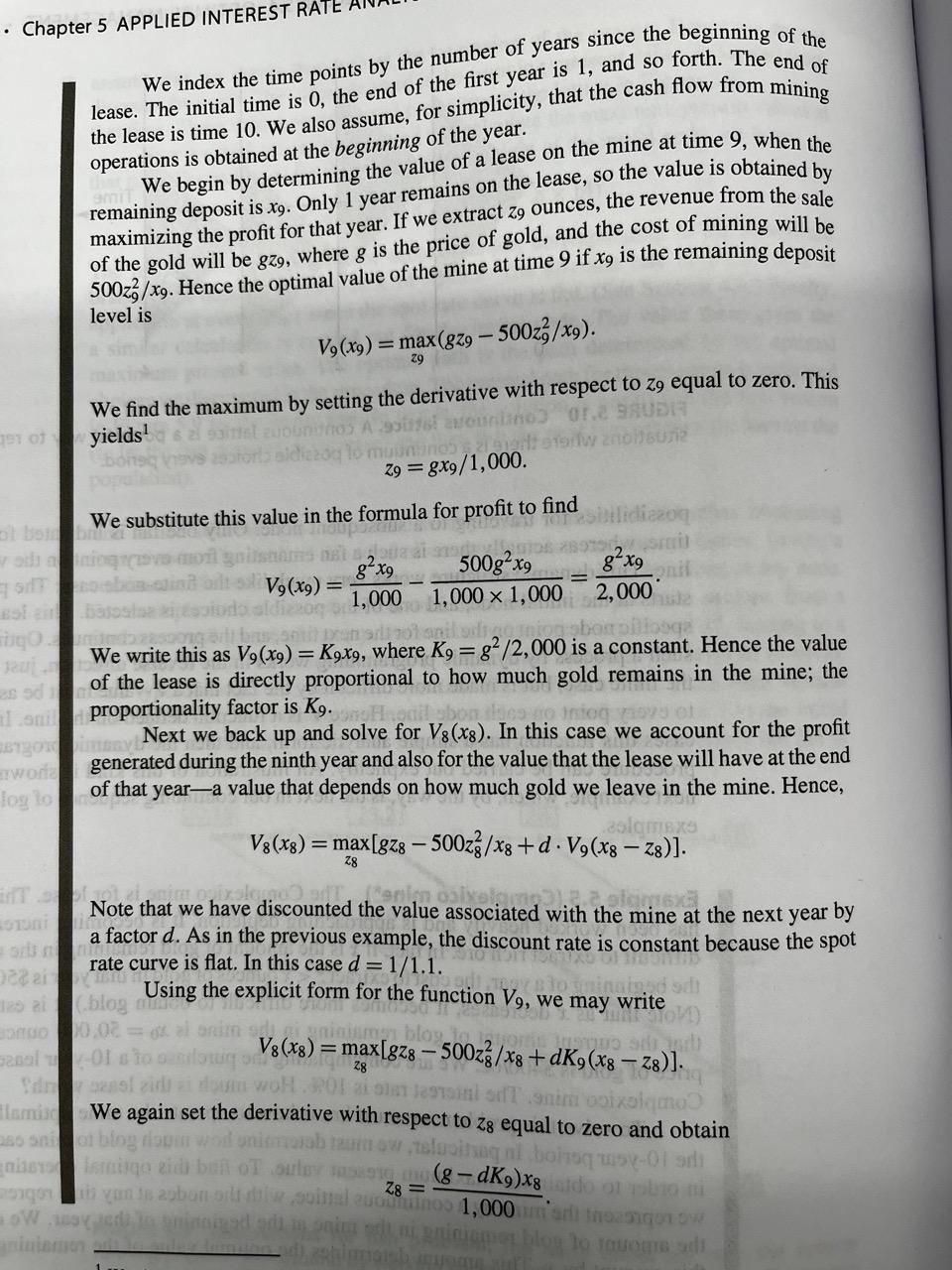

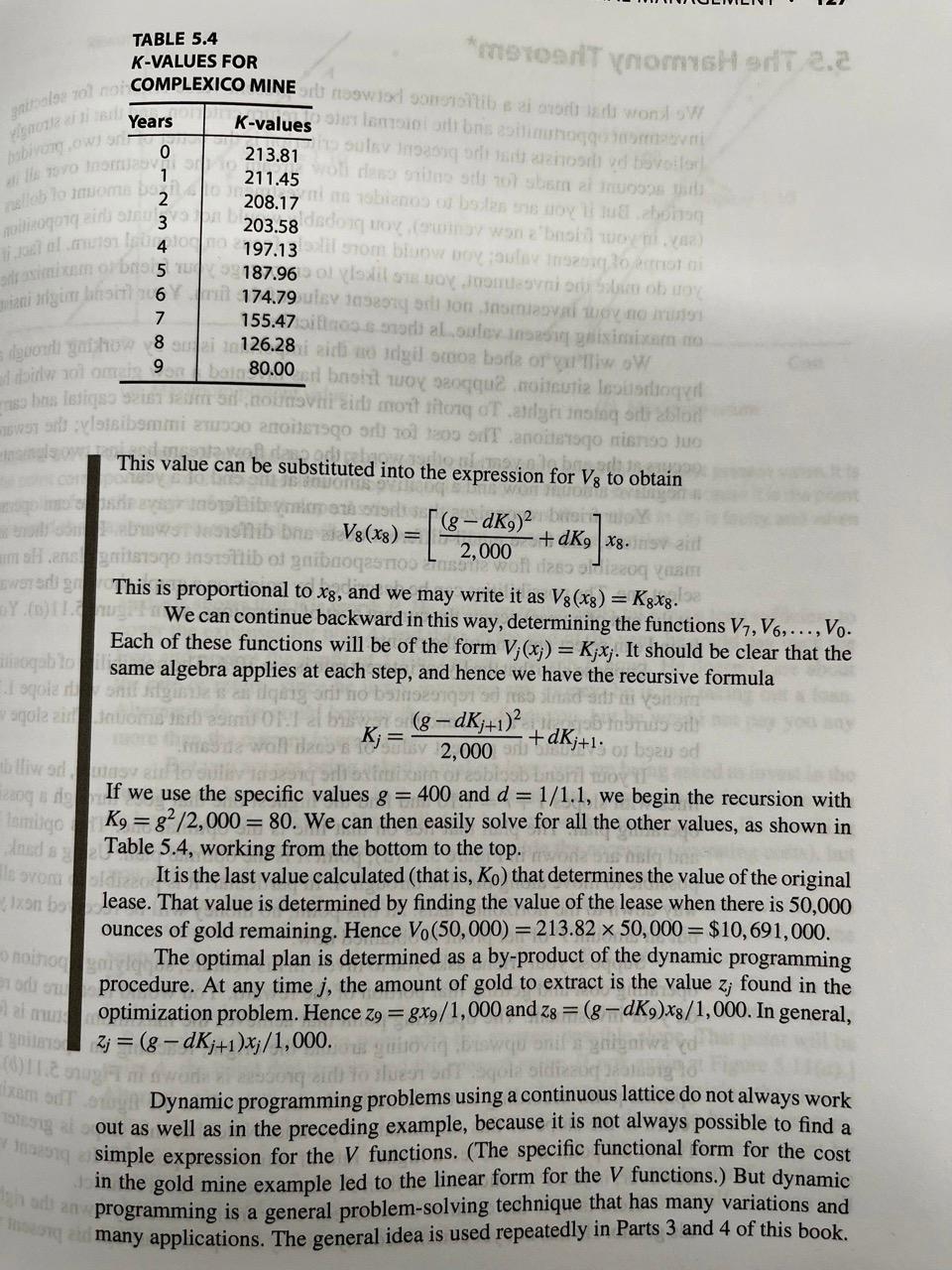

8. (Complexico mine 0) Consider the Complexico mine and assume a 10% constant interest rate; also assume the price of gold is constant at $400/oz. = (a) Find the value of the mine (not a 10-year lease) if the current deposit is xo. In particular, how much is the mine worth initially when xo = 50,000 ounces? (Hint: Consider the recursive equation for Kk as k 00.] (b) For the 10-year lease considered in the text, how much gold remains in the mine at the end of the lease; and how much is the mine worth at that time? (c) If the mine were not leased, but instead operated optimally by an owner, what would the mine be worth after 10 years? next example, which, by the way, is the next in our continuing sequence of gold mine examples. 15 SU Example 5.5 (Complexico mine*) The Complexico mine is for lease. This mine has been worked heavily and is approaching depletion. It is becoming increasingly difficult to extract rich ore. In fact, if x is the amount of gold remaining in the mine at the beginning of a year, the cost to extract z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts