Question: 8. Compute the expected return given these three economic states, their probabilities, and the potential retums: Fast Growth Slow Growth Recession 0.10 0.50 0.40 50%

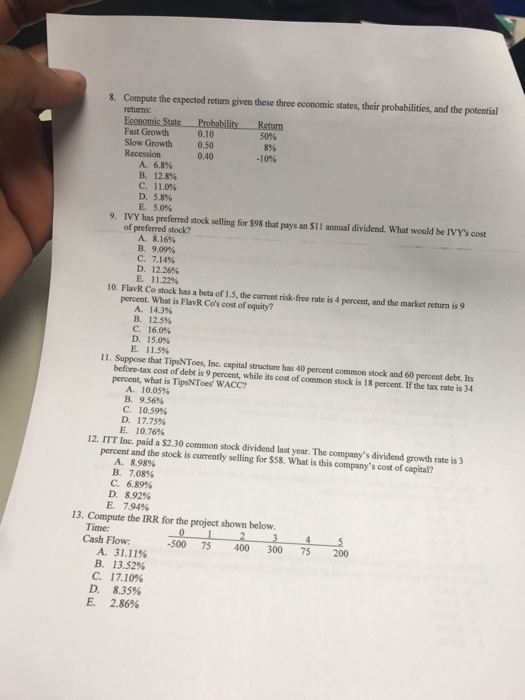

8. Compute the expected return given these three economic states, their probabilities, and the potential retums: Fast Growth Slow Growth Recession 0.10 0.50 0.40 50% 896 -10% A. 6.8% B. 12.8% C.11.0% D. 5.8% E.5.0% 9 IVY has preferred stock selling for S98 that pays an SII annual dividend. what would be IVY's cost of preferred stock? A, 8.16% B. 909% C. 7.14% D. 12.26% B. 11.22% 10. FlavR Co stock has a beta of 1.5, the current risk-free rate is 4 percent, and the market return is 9 percent. What is FlavR Co's cost of equity? A. 14.3% B. 12.5% C. 160% D. 15.0% E. 11.5% 11. Suppose that TipsNToes, Inc. capital structure has 40 percent common stock and 60 percent debt. Its before-tax cost of debt is 9 percent while its cost of common stock is 18 percent. If the tax rate is 34 percent, what is TipsNToes WACC? A. 10.05% B. 9.56% C. 10.59% D. 17.75% E. 10.76% 12. ITT Inc. paid a $2.30 common stock dividend last year. The company's dividend growth rate is 3 percent and the stock is currently selling for $58. What is this company's cost of capital? A. 8.98% B. 7.08% C. 6.89% D. 8.92% E. 7.94% 13. Compute the IRR for the project shown below. Time: Cash Flow -500 75 400 300 75 200 A. 31.11% B. 13.52% C. 17.10% D. 8.35% E. 2.86%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts