Question: 8. Conputing the federal transfer tax - Practice 1 When Leonard Fulier died in 2012, he left an estate valued at $25,000,000. His trust directed

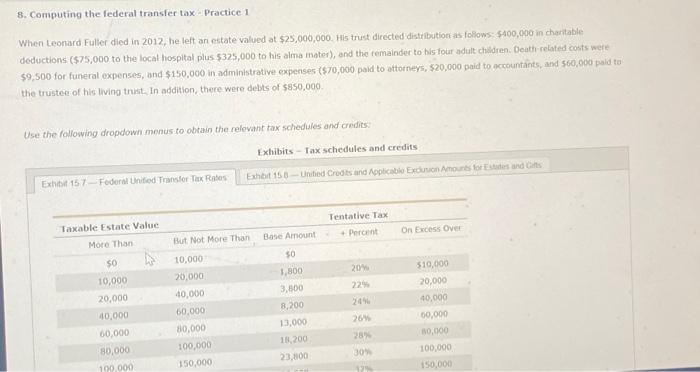

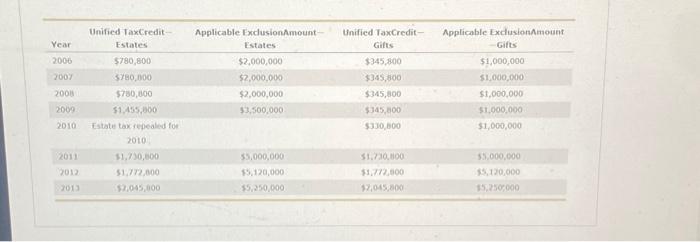

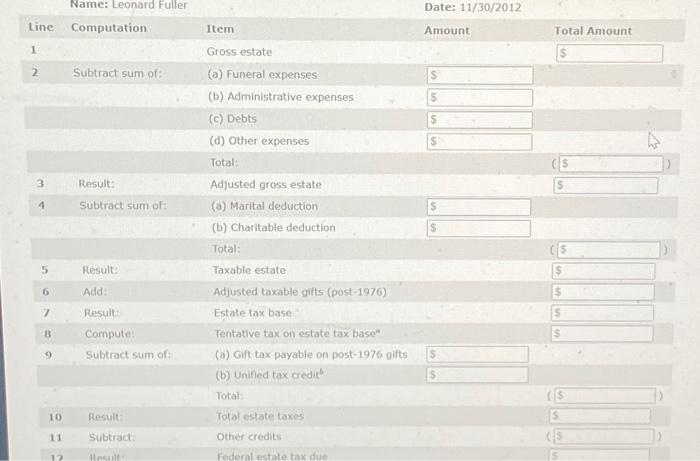

8. Conputing the federal transfer tax - Practice 1 When Leonard Fulier died in 2012, he left an estate valued at $25,000,000. His trust directed distribution as foilows: $400,000 in chartable deductions ( $75,000 to the local hospltal plus 5325,000 to his alma moter), and the remainder to his four adult chlidren. Deathi related costs were $9,500 for funeral expenses, and $150,000 in.administrative expenses ( $70,000 paid to ottorney5, $20,000 paid bo accountants, and 560,000 paid ta the truistee of his living trist. In addition, there were debts of 5850.000 . Unified TaxCredit - Applicable ExdusionAmount- Unified TaxCredit- Applicable ExclusionAmount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts