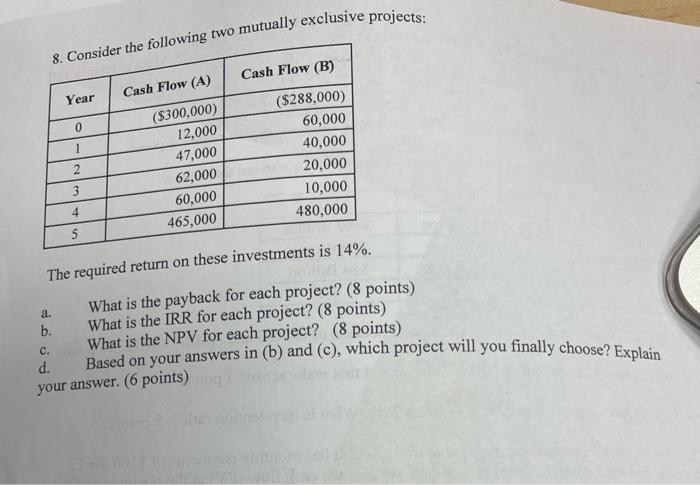

Question: 8. Consider the following two mutually exclusive projects: Cash Flow (B) Cash Flow (A) Year 0 1 ($288,000) 60,000 40,000 20,000 10,000 480,000 ($300,000) 12,000

8. Consider the following two mutually exclusive projects: Cash Flow (B) Cash Flow (A) Year 0 1 ($288,000) 60,000 40,000 20,000 10,000 480,000 ($300,000) 12,000 47,000 62,000 60,000 465,000 2 3 4 5 The required return on these investments is 14%. What is the payback for each project? (8 points) What is the IRR for each project? (8 points) What is the NPV for each project? (8 points) Based on your answers in (b) and (c), which project will you finally choose? Explain your answer. (6 points) a. b. c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts