Question: 8. Consider the Ho-Lee model [ left{begin{array}{l} d r(t)=Theta(t) d t+sigma d W(t), quad t geq 0 r(0)=r_{0} end{array} ight. ] for the short

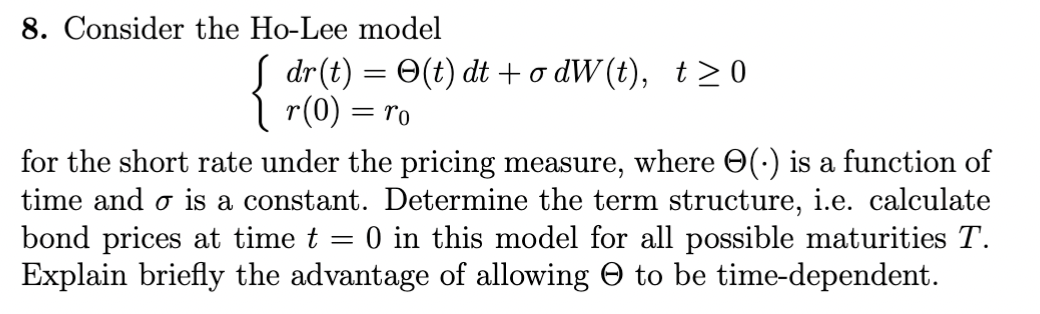

8. Consider the Ho-Lee model \\[ \\left\\{\\begin{array}{l} d r(t)=\\Theta(t) d t+\\sigma d W(t), \\quad t \\geq 0 \\\\ r(0)=r_{0} \\end{array}\ ight. \\] for the short rate under the pricing measure, where \\( \\Theta(\\cdot) \\) is a function of time and \\( \\sigma \\) is a constant. Determine the term structure, i.e. calculate bond prices at time \\( t=0 \\) in this model for all possible maturities \\( T \\). Explain briefly the advantage of allowing \\( \\Theta \\) to be time-dependent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts