Question: 8. Consider the utility function for the representative consumer: U(C, 1) = C04106 where C - consumption good and /= leisure. Suppose that representative consumer

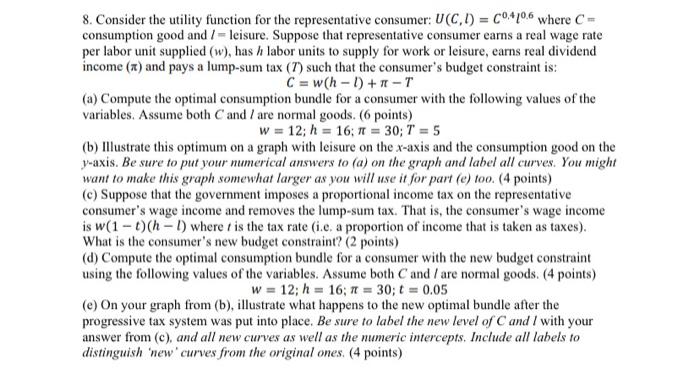

8. Consider the utility function for the representative consumer: U(C, 1) = C04106 where C - consumption good and /= leisure. Suppose that representative consumer earns a real wage rate per labor unit supplied (w), has h labor units to supply for work or leisure, earns real dividend income (T) and pays a lump sum tax (1) such that the consumer's budget constraint is: C = wh-1) +-T (a) Compute the optimal consumption bundle for a consumer with the following values of the variables. Assume both Cand / are normal goods. (6 points) W = 12; h = 16; 7 = 30; T = 5 (b) Illustrate this optimum on a graph with leisure on the x-axis and the consumption good on the y-axis. Be sure to put your numerical answers to (a) on the graph and label all curves. You might want to make this graph somewhat larger as you will use it for part (e) too. (4 points) (C) Suppose that the government imposes a proportional income tax on the representative consumer's wage income and removes the lump-sum tax. That is, the consumer's wage income is w(1 - 1)(h - 1) where is the tax rate (.e. a proportion of income that is taken as taxes). What is the consumer's new budget constraint? (2 points) (d) Compute the optimal consumption bundle for a consumer with the new budget constraint using the following values of the variables. Assume both Cand / are normal goods. 4 points) w = 12; h = 16; 7 = 30; t = 0.05 (e) On your graph from (b), illustrate what happens to the new optimal bundle after the progressive tax system was put into place. Be sure to label the new level of Cand / with your answer from (c), and all new curves as well as the numeric intercepts. Include all labels to distinguish 'new' curves from the original ones. (4 points) 8. Consider the utility function for the representative consumer: U(C, 1) = C04106 where C - consumption good and /= leisure. Suppose that representative consumer earns a real wage rate per labor unit supplied (w), has h labor units to supply for work or leisure, earns real dividend income (T) and pays a lump sum tax (1) such that the consumer's budget constraint is: C = wh-1) +-T (a) Compute the optimal consumption bundle for a consumer with the following values of the variables. Assume both Cand / are normal goods. (6 points) W = 12; h = 16; 7 = 30; T = 5 (b) Illustrate this optimum on a graph with leisure on the x-axis and the consumption good on the y-axis. Be sure to put your numerical answers to (a) on the graph and label all curves. You might want to make this graph somewhat larger as you will use it for part (e) too. (4 points) (C) Suppose that the government imposes a proportional income tax on the representative consumer's wage income and removes the lump-sum tax. That is, the consumer's wage income is w(1 - 1)(h - 1) where is the tax rate (.e. a proportion of income that is taken as taxes). What is the consumer's new budget constraint? (2 points) (d) Compute the optimal consumption bundle for a consumer with the new budget constraint using the following values of the variables. Assume both Cand / are normal goods. 4 points) w = 12; h = 16; 7 = 30; t = 0.05 (e) On your graph from (b), illustrate what happens to the new optimal bundle after the progressive tax system was put into place. Be sure to label the new level of Cand / with your answer from (c), and all new curves as well as the numeric intercepts. Include all labels to distinguish 'new' curves from the original ones. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts