Question: #8 Consider two loans with a 1-year maturity and identical face values: a(n)8.0% loan with a 1.00% loan origination fee and a(n) 8.0% loan with

#8

#8

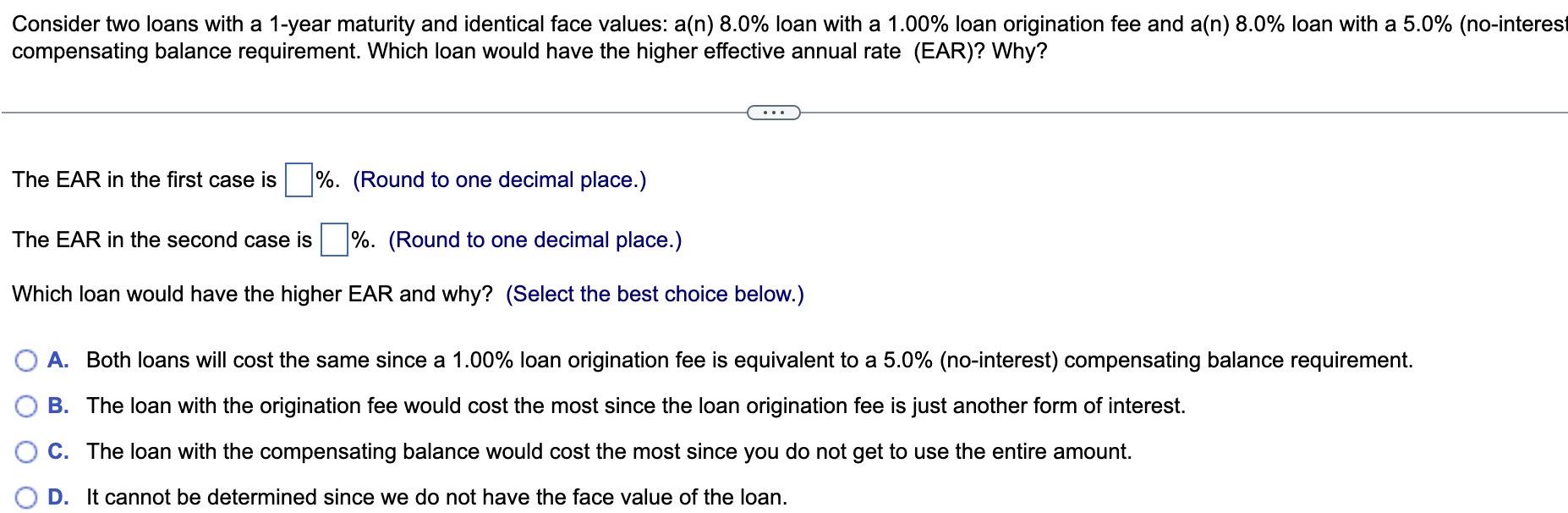

Consider two loans with a 1-year maturity and identical face values: a(n)8.0% loan with a 1.00% loan origination fee and a(n) 8.0% loan with a 5.0% (no-inter compensating balance requirement. Which loan would have the higher effective annual rate (EAR)? Why? The EAR in the first case is \%. (Round to one decimal place.) The EAR in the second case is \%. (Round to one decimal place.) Which loan would have the higher EAR and why? (Select the best choice below.) A. Both loans will cost the same since a 1.00% loan origination fee is equivalent to a 5.0% (no-interest) compensating balance requirement. B. The loan with the origination fee would cost the most since the loan origination fee is just another form of interest. C. The loan with the compensating balance would cost the most since you do not get to use the entire amount. D. It cannot be determined since we do not have the face value of the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts