Question: 8. Daleel plc is trying to introduce an improved method of assessing investment projects using discounted cash flow techniques. For this it has to obtain

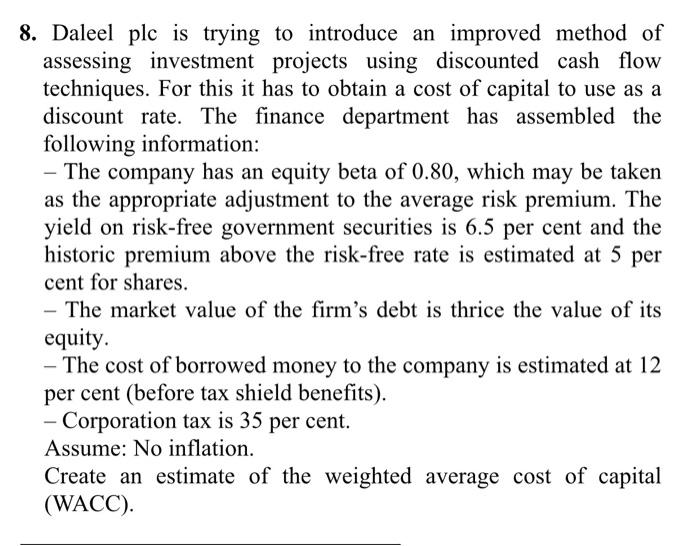

8. Daleel plc is trying to introduce an improved method of assessing investment projects using discounted cash flow techniques. For this it has to obtain a cost of capital to use as a discount rate. The finance department has assembled the following information: - The company has an equity beta of 0.80, which may be taken as the appropriate adjustment to the average risk premium. The yield on risk-free government securities is 6.5 per cent and the historic premium above the risk-free rate is estimated at 5 per cent for shares. - The market value of the firm's debt is thrice the value of its equity. - The cost of borrowed money to the company is estimated at 12 per cent (before tax shield benefits). - Corporation tax is 35 per cent. Assume: No inflation. Create an estimate of the weighted average cost of capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts