Question: 8. Decision Case 6-1 Avume you are opening a Red Hath &c Reyond store. To finance the businews, you need a $500,000 loan, and your

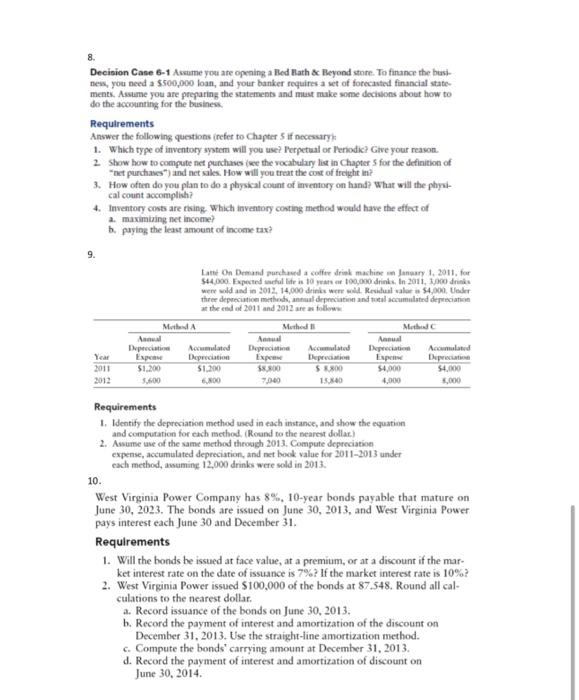

8. Decision Case 6-1 Avume you are opening a Red Hath \&c Reyond store. To finance the businews, you need a $500,000 loan, and your banker roquires a set of forccanted financial statements. Assume you are preparing the statements and must muke some decisons about how to do the accounting for the busines. Requlrements Answer the following questions irefet to Chapter 5 if necessary): 1. Which type of inventory system will you use? Ferpetual or Reriodic? Give your reason. 2. Show how to compute net punchas ine the vocabulary lis in Chapter 5 for the definition of "net purchases") and net sales. How witt you treat the cour of frelght in? 3. How ofien do you plan to do a physical count of imventory on hand? What will the physical count accomplish? 4. Inventory costs are toing, which inventory conting method would have the effect of a. maximiaing net income? b. puying the least amount of income tax? 9. Later On Demand purchand a coffer driek machier en Janaary 1, 2011, for at the esd of 2011 and 2012 ane w follown. Requirements 1. Identify the depreciation method used in each instance, and show the equation and computation for each method. (Round to the nearest dollax.) 2. Asume use of the same method throagh 2013. Compute depreciation expense, accumulated depreciation, and net boct value for 20112013 under each method, awamine 12,000 drinks were sold in 2013. 10. West Virginia Power Company has 8%, 10-year bonds payable that mature on June 30, 2023. The bonds are issued on June 30, 2013, and West Virginia Power pays interest each June 30 and December 31. Requirements 1. Will the bonds be issued at face value, at a premium, or at a discount if the market interest rate on the date of issuance is 7% ? If the market interest rate is 10% ? 2. West Virginia Power issued $100,000 of the bonds at 87.548 . Round all calculations to the nearest dollar. a. Record issuance of the bonds on June 30, 2013. b. Record the payment of interest and amortization of the discount on December 31, 2013. Use the straight-line amortization method. c. Compute the bonds' carrying amount at Decemher 31, 2013. d. Record the payment of interest and amortization of discount on June 30,2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts