Question: 8 does this help? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising Instead of

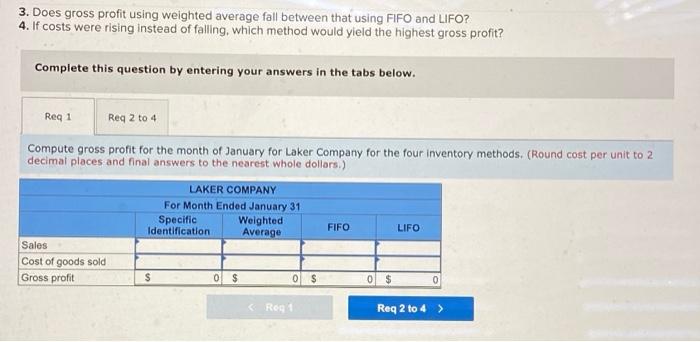

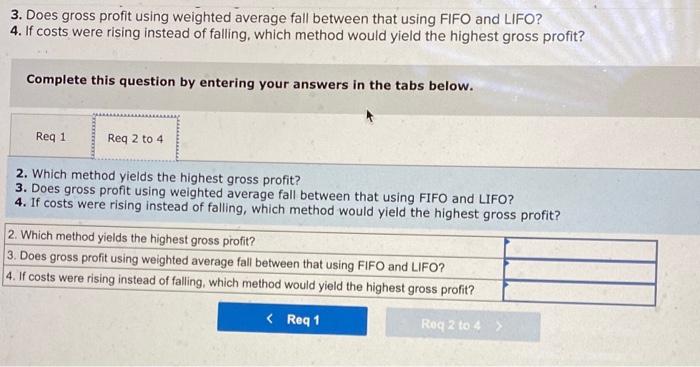

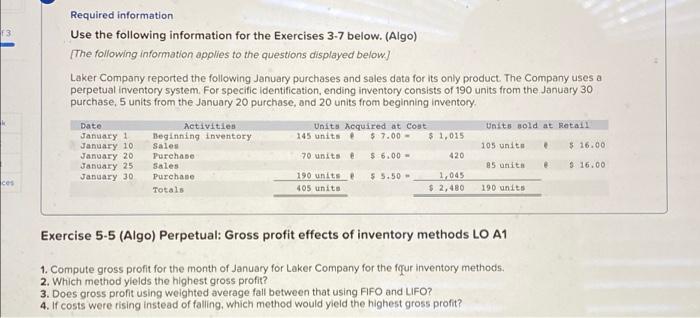

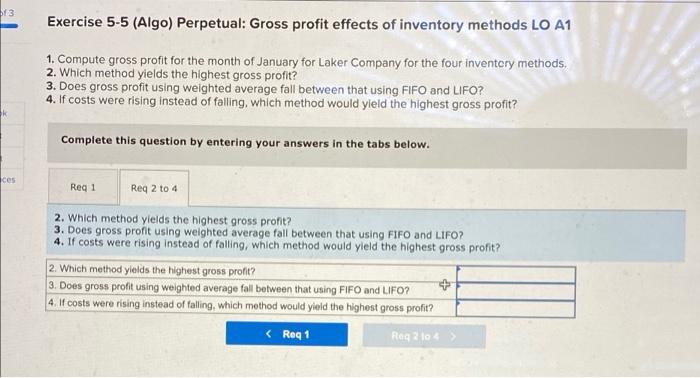

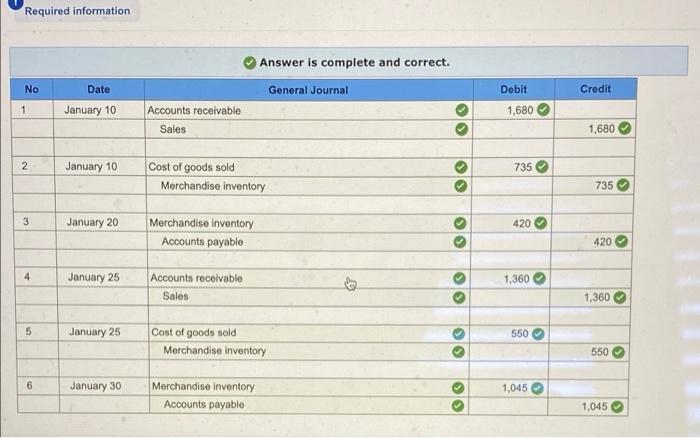

3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising Instead of falling, which method would yield the highest gross profit? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Compute gross profit for the month of January for Laker Company for the four inventory methods. (Round cost per unit to 2 decimal places and final answers to the nearest whole dollars.) LAKER COMPANY For Month Ended January 31 Specific Weighted FIFO Ider LIFO Average Sales Cost of goods sold Gross profit $ 0 $ 0 $ S 0 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? Complete this question by entering your answers in the tabs below. Reg 1 Req 2 to 4 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? Merchandise inventory Accounts payable 420 4 January 25 1,360 Accounts receivable Sales >> 1,360 5 January 25 550 Cost of goods sold Merchandise inventory 550 6 January 30 > 1,045 Merchandise inventory Accounts payable 1.045

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts