Question: 8 During 2 0 2 2 , a company purchased a mine at a cost of $ 4 , 1 7 1 , 0 0

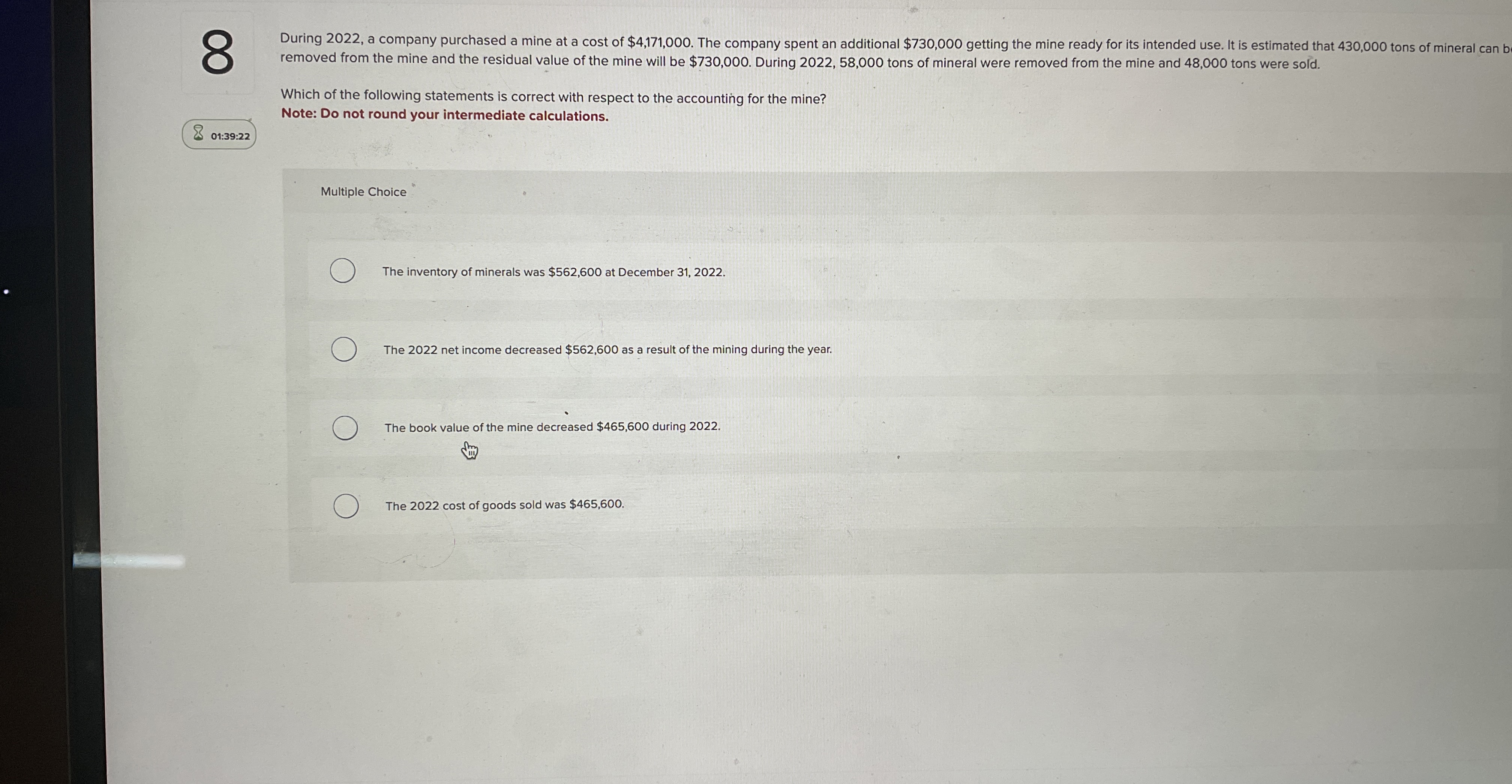

During a company purchased a mine at a cost of $ The company spent an additional $ getting the mine ready for its intended use. It is estimated that tons of mineral can b removed from the mine and the residual value of the mine will be $ During tons of mineral were removed from the mine and tons were sold.

Which of the following statements is correct with respect to the accounting for the mine?

Note: Do not round your intermediate calculations.

Multiple Choice

The inventory of minerals was $ at December

The net income decreased $ as a result of the mining during the year.

The book value of the mine decreased $ during

The cost of goods sold was $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock