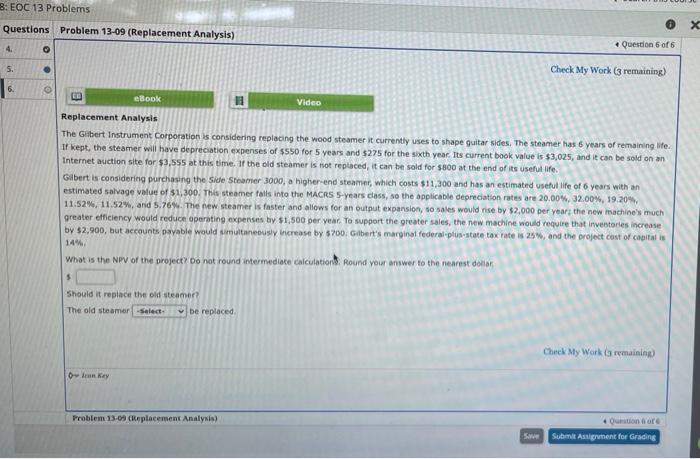

Question: 8: EOC 13 Problems Questions Problem 13-09 (Replacement Analysis) X Question 6 of 6 . 5. Check My Work (3 remaining) 6. eBook Video Replacement

8: EOC 13 Problems Questions Problem 13-09 (Replacement Analysis) X Question 6 of 6 . 5. Check My Work (3 remaining) 6. eBook Video Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamer It currently uses to shape guitar sides. The steamer has 6 years of remainingite If kept, the steamer will have depreciation expenses of $550 for 5 years and $275 for the sixth year. Its current book value is $3,025, and it can be sold on an Internet auction site for $3,555 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the site Steamer 3000, a higher-end steamer, which costs $11,300 and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20 11.52%, 11.52% and 5.76%. The new steamer is faster and allows for an outout expansion, so sales would rise by $2,000 per year, the new machine's much greater efficiency would reduce operating expenses by $1,500 per year. To support the greater sales, the new machine would require that inventaries increase by $2,900, butaca ints payable would simultaneously increase by 5700 Gilbert's marginal federal-plus-state tax rate is 25%, and the project cost of capitalis 14% What is the NPV of the project? Do not round intermediate calculation. Round your answer to the nearest dolor 5 Should it replace the old steamer? The old steamer - Select be replaced Check My Work remaining) 0 Key Problem 13-05 (Replacement Analysis) Sor Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts