Question: 8. Exchange rate forecasting: Market-based forecasting 1. 2 . STEP: 2 of 2 Suppose that a company uses the 90-day forward rate on British pounds

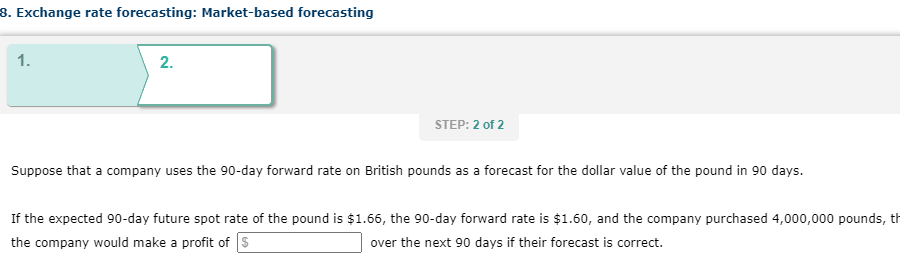

8. Exchange rate forecasting: Market-based forecasting 1. 2 . STEP: 2 of 2 Suppose that a company uses the 90-day forward rate on British pounds as a forecast for the dollar value of the pound in 90 days. If the expected 90-day future spot rate of the pound is $1.66, the 90-day forward rate is $1.60, and the company purchased 4,000,000 pounds, th the company would make a profit of $ over the next 90 days if their forecast is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts