Question: 8. Finance charge calculation - The add-on method The add-on method is a videly used technique for computing interest on installment loans. With the add-on

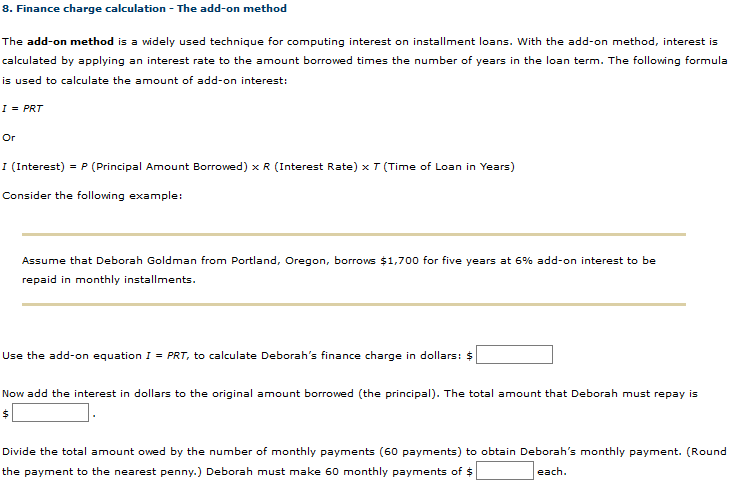

8. Finance charge calculation - The add-on method The add-on method is a videly used technique for computing interest on installment loans. With the add-on method, interest is calculated by applying an interest rate to the amount borrowed times the number of years in the loan term. The following formula is used to calculate the amount of add-on interest: I = PRT Or I (Interest) = P(Principal Amount Borrowed) x R (Interest Rate) x T (Time of Loan in Years) Consider the following example: Assume that Deborah Goldman from Portland, Oregon, borrows $1,700 for five years at 6% add-on interest to be repaid in monthly installments. Use the add-on equation I = PRT, to calculate Deborah's finance charge in dollars: $ Now add the interest in dollars to the original amount borrowed (the principal). The total amount that Deborah must repay is $ Divide the total amount owed by the number of monthly payments (50 payments) to obtain Deborah's monthly payment. (Round the payment to the nearest penny.) Deborah must make 60 monthly payments of $ each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts