Question: (8) For two mutually exclusive projects with normal cash flows (both with investments at Year O and have the same discount rate) under consideration, which

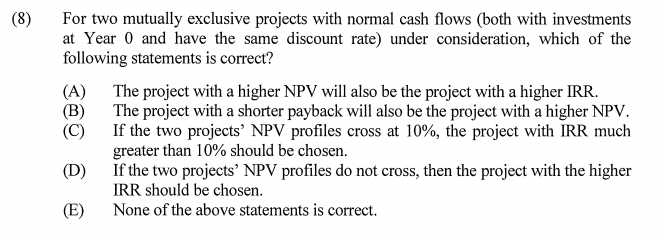

(8) For two mutually exclusive projects with normal cash flows (both with investments at Year O and have the same discount rate) under consideration, which of the following statements is correct? (A) The project with a higher NPV will also be the project with a higher IRR. (B) The project with a shorter payback will also be the project with a higher NPV. (C) If the two projects' NPV profiles cross at 10%, the project with IRR much greater than 10% should be chosen. (D) If the two projects' NPV profiles do not cross, then the project with the higher IRR should be chosen. (E) None of the above statements is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts