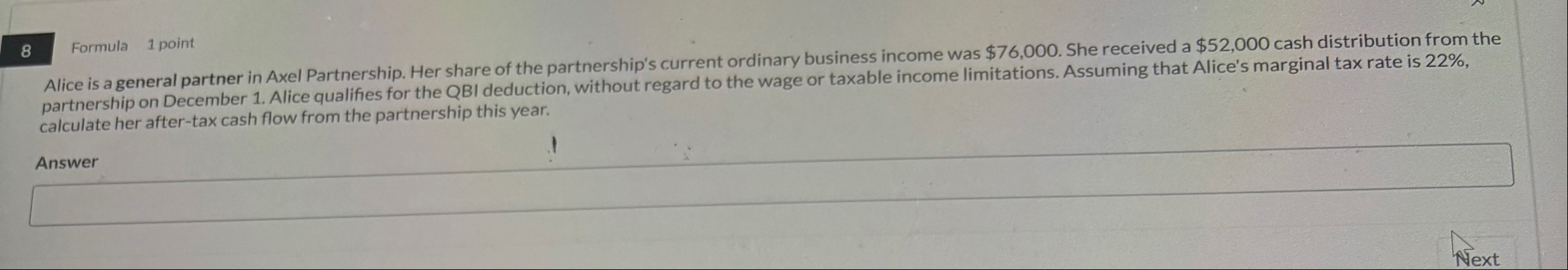

Question: 8 Formula 1 point Alice is a general partner in Axel Partnership. Her share of the partnership's current ordinary business income was $ 7 6

Formula point

Alice is a general partner in Axel Partnership. Her share of the partnership's current ordinary business income was $ She received a $ cash distribution from the partnership on December Alice qualifies for the QBI deduction, without regard to the wage or taxable income limitations Assuming that Alice's marginal tax rate is calculate her aftertax cash flow from the partnership this year.

Answer

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock