Question: 8. Given that i = 10% and the data below: Alternative Project A Project B First Cost($) -50,000 -80,000 Annual Cost ($/yr) -20,000 -10,000 Salvage

8. Given that i = 10% and the data below:

| Alternative | Project A | Project B |

| First Cost($) | -50,000 | -80,000 |

| Annual Cost ($/yr) | -20,000 | -10,000 |

| Salvage value ($) | 10,000 | 25,000 |

| Life, years | 3 | 6 |

The cost recovery for project A and B are respectively;

a. CR=$25,128 for project A and CR=$37,084 for project B

b. CR=$15,128 for project A and CR=$17,084 for project B

c. CR=$17,084 for project A and CR=$15,129 for project B

d. CR=$43,126 for project A and CR=$31,600 for project B

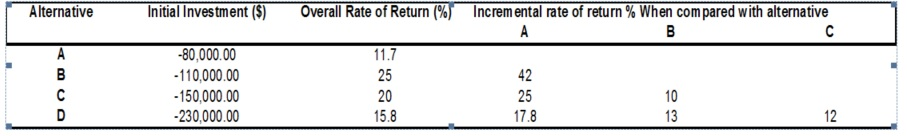

Questions 9-11. The four Cost alternatives described below are being evaluated.

9. If the proposals are independents, which one(s) should be selected with MARR =18%?

a. Alternative A, B, C, and D

b. Alternative B, C, and D

c. Only Alternative B

d. Only Alternative B and C

10. If the proposals are mutually exclusive, which should be selected with MARR=15%?

a. Alternative A, B, C, and D

b. Only alternative B

c. Alternative B and C

d. Only alternative C

11. If the proposals are mutually exclusive, which should be selected with MARR=10%?

a. Select alternative D

b. Select alternative C

c. Select alternative B

d. Select all alternatives A, B, C, and D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts