Question: 8 . Imagine we are given a choice between the following two investment options: Investment A: With 1 0 0 % certainty, we receive

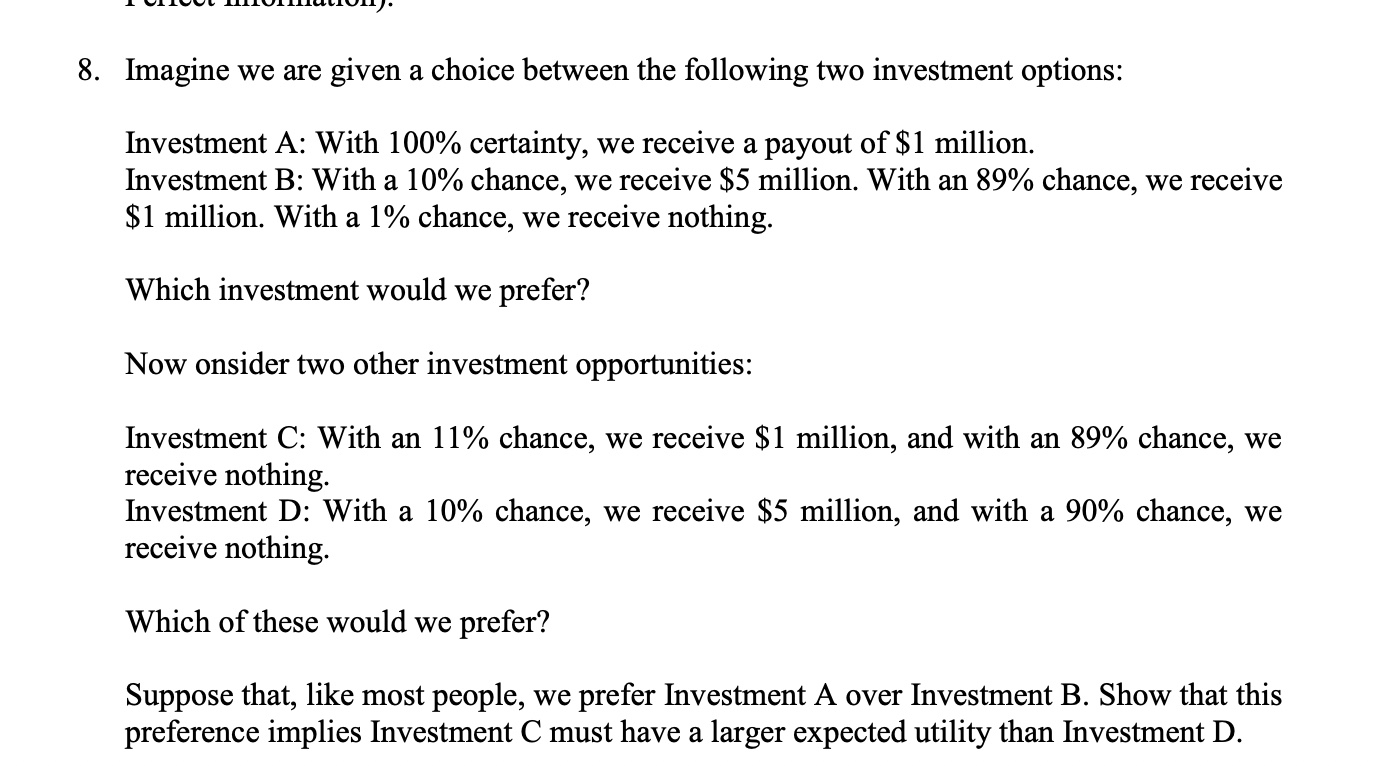

Imagine we are given a choice between the following two investment options:

Investment A: With certainty, we receive a payout of $ million.

Investment B: With a chance, we receive $ million. With an chance, we receive $ million. With a chance, we receive nothing.

Which investment would we prefer?

Now onsider two other investment opportunities:

Investment C: With an chance, we receive $ million, and with an chance, we receive nothing.

Investment D: With a chance, we receive $ million, and with a chance, we receive nothing.

Which of these would we prefer?

Suppose that, like most people, we prefer Investment A over Investment B Show that this preference implies Investment C must have a larger expected utility than Investment D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock