Question: 8. It can be shown that the solution to the above immunization problem is to invest in: 22,650.14 Bonds of Type B and 30,528.78 Bonds

8. It can be shown that the solution to the above immunization problem is to invest in: 22,650.14 Bonds of Type B and 30,528.78 Bonds of Type D. Based on the concept of duration and convexity, what is the percentage change in this portfolio if interest rates increase by 1% at all maturities? A. Decrease by 9.355% B. Decrease by 10.062% C. Decrease by 12.339% D. Decrease by 13.331% E. None of the Above

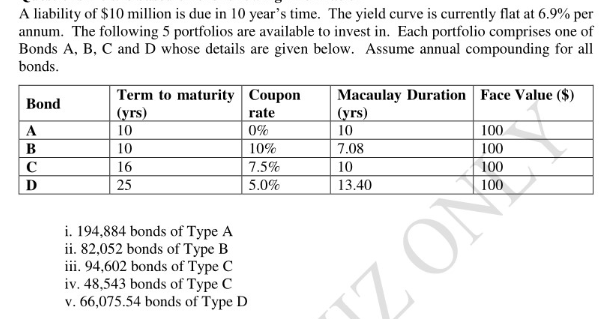

A liability of $10 million is due in 10 year's time. The yield curve is currently flat at 6.9% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. Term to maturity Coupon Bond Macaulay Duration Face Value ($) (yrs) rate (yrs) A 10 0% 10 100 B 10 10% 7.08 100 16 7.5% 100 D 25 5.0% 13.40 100 10 i. 194,884 bonds of Type A ii. 82,052 bonds of Type B iii. 94,602 bonds of Type C iv. 48,543 bonds of Type C v. 66,075.54 bonds of Type D UZ OM A liability of $10 million is due in 10 year's time. The yield curve is currently flat at 6.9% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. Term to maturity Coupon Bond Macaulay Duration Face Value ($) (yrs) rate (yrs) A 10 0% 10 100 B 10 10% 7.08 100 16 7.5% 100 D 25 5.0% 13.40 100 10 i. 194,884 bonds of Type A ii. 82,052 bonds of Type B iii. 94,602 bonds of Type C iv. 48,543 bonds of Type C v. 66,075.54 bonds of Type D UZ OM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts