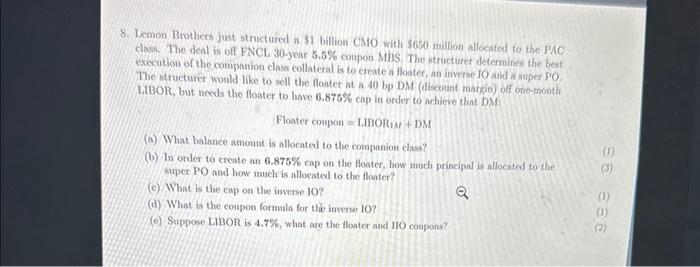

Question: 8. Lemon Brothers just structured a $1 billion CAIO with $650 million allocated to the PAC Class. The deal is off FNCL 30-year 5.5% cotpon

8. Lemon Brothers just structured a \$1 billion CAIO with $650 million allocated to the PAC Class. The deal is off FNCL 30-year 5.5\% cotpon MBS. Tho ntructuret determines the best exceution of the companion class collateral is to create a floater, an inverse 10 and a super PO. The structure would like to sell the flonter at a 40 bp DM (disconint margin) off one-month LIBOR, but needs the floater to have 6.875% cap in order to achieve that DM: Floater coupon =L.IBORM + DM (a) What balance amount is allocated to the cotppanion class? (b) In order to create an 6.875% cap on the flooter, how much principal is allocated to the buper PO and how much is allocated to the floster? (c) What is the eap on the inverne 10? (d) What is the coupon formala for thie inverno 10 ? (e) Suppose LIBOR is 4.7%, what are the flonter and 110 coupons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts