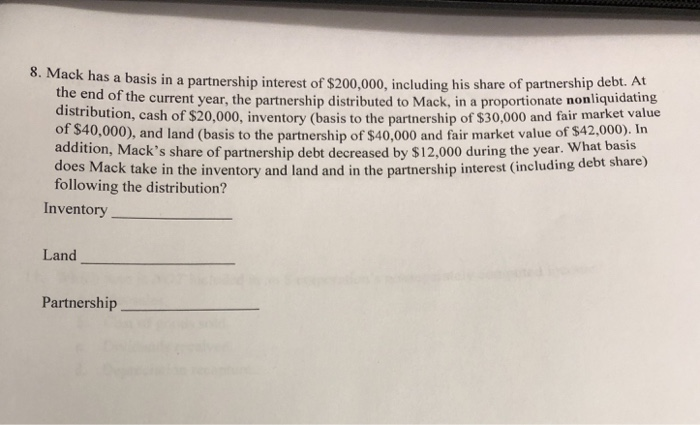

Question: 8. Mac k has a basis in a partnership interest of $200,000, including his share of partnership debt. At he end of the current year,

8. Mac k has a basis in a partnership interest of $200,000, including his share of partnership debt. At he end of the current year, the distribution, cash of $20,000, inventory (basis to the partnership of $30,000 and fair market value of $40,000), and land (basis to the partnership of $40,000 and fair market value of $42,000). In addition, Mack's share of partnership debt decreased by S12,000 during the year. What basi does Mack take in the inventory and land and in the partnership interest (including debt following the distribution? partnership distributed to Mack, in a proportionate nonliquidating share) Inventory Land Partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts