Question: 8. Marketing Analytics: Competitor Analysis Marketing Analytics: Competitor Analysis Instructions: Read the problem below and refer to the spreadsheet provided. The spreadsheet values highlighted in

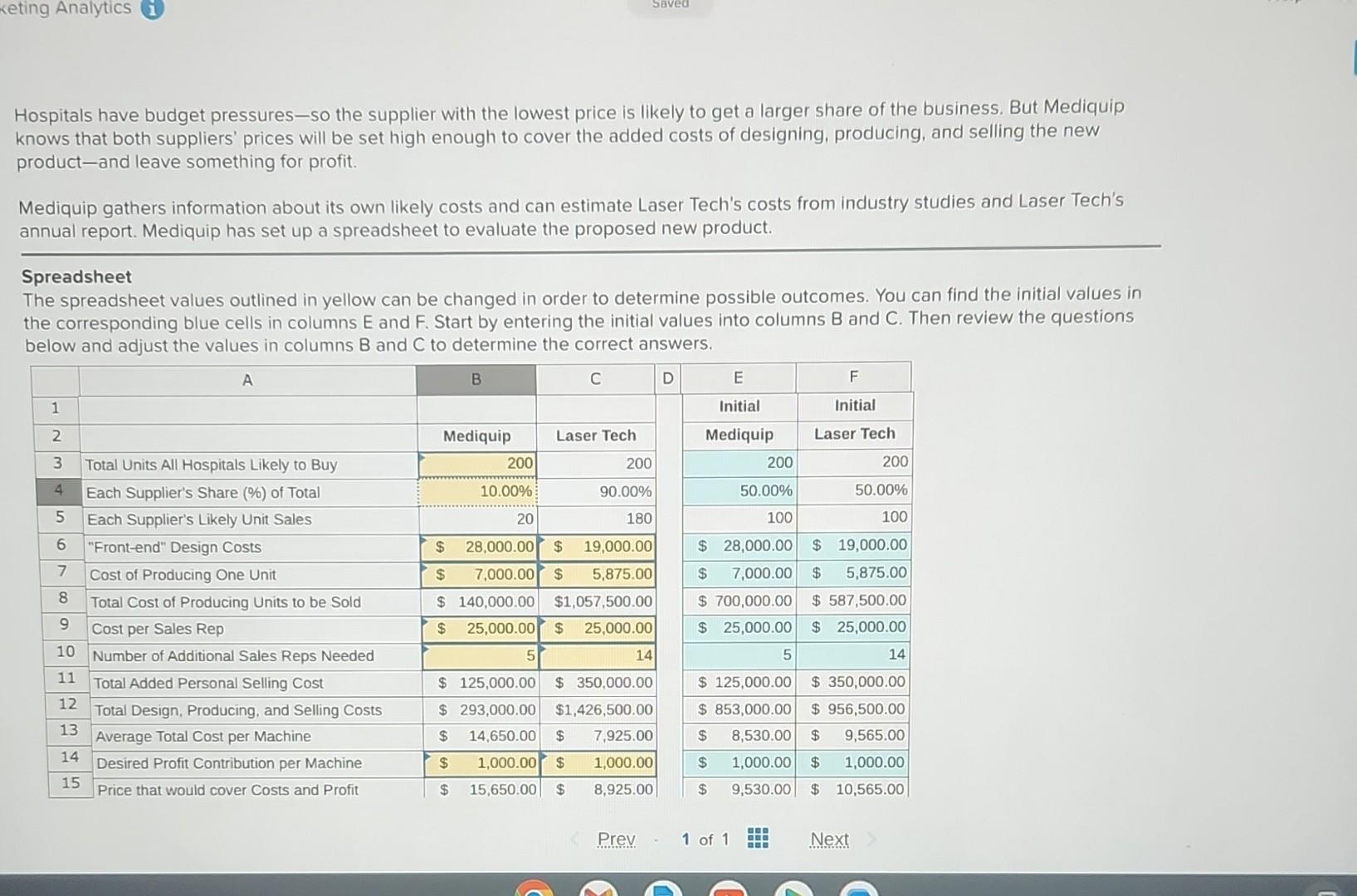

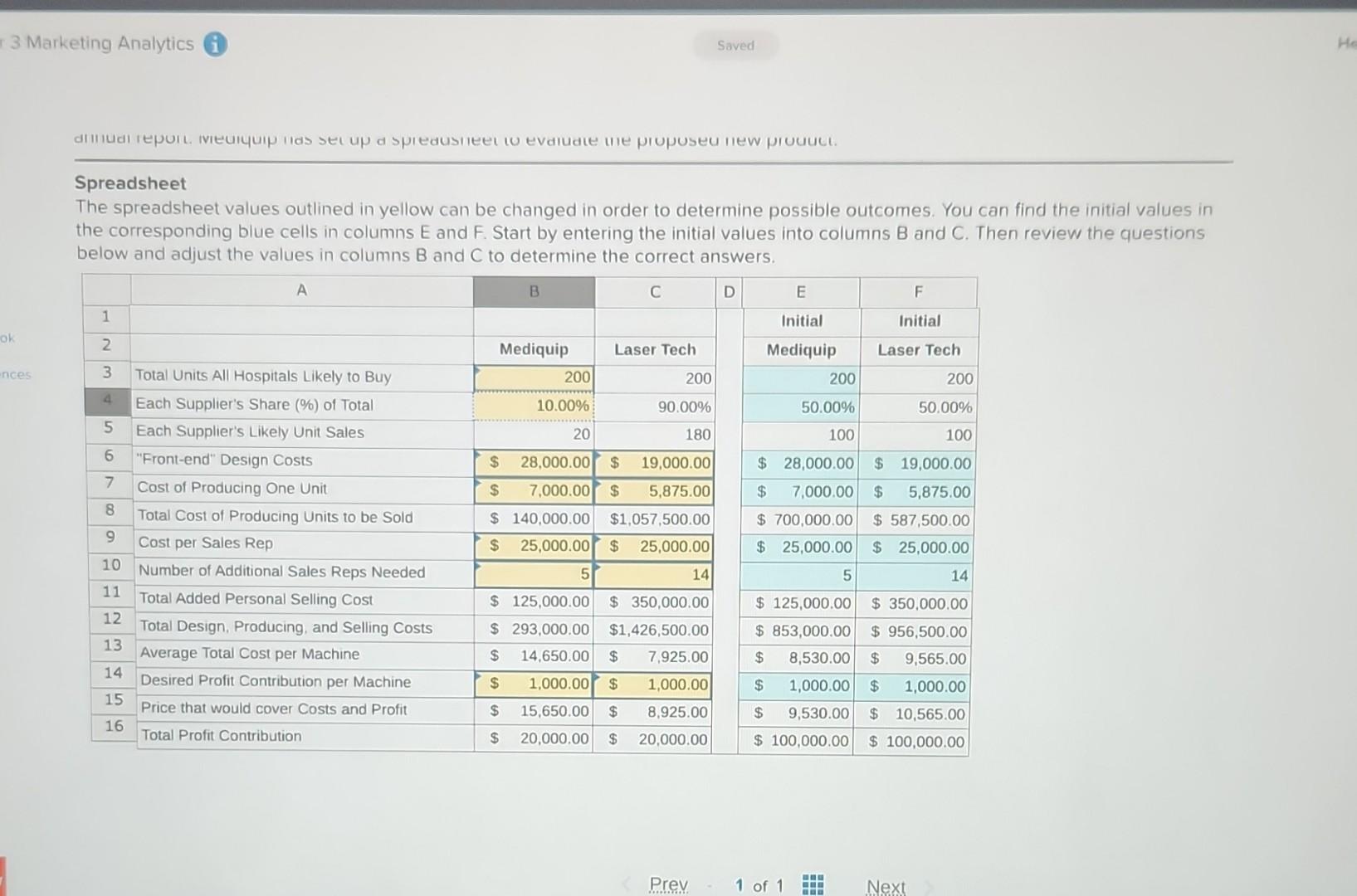

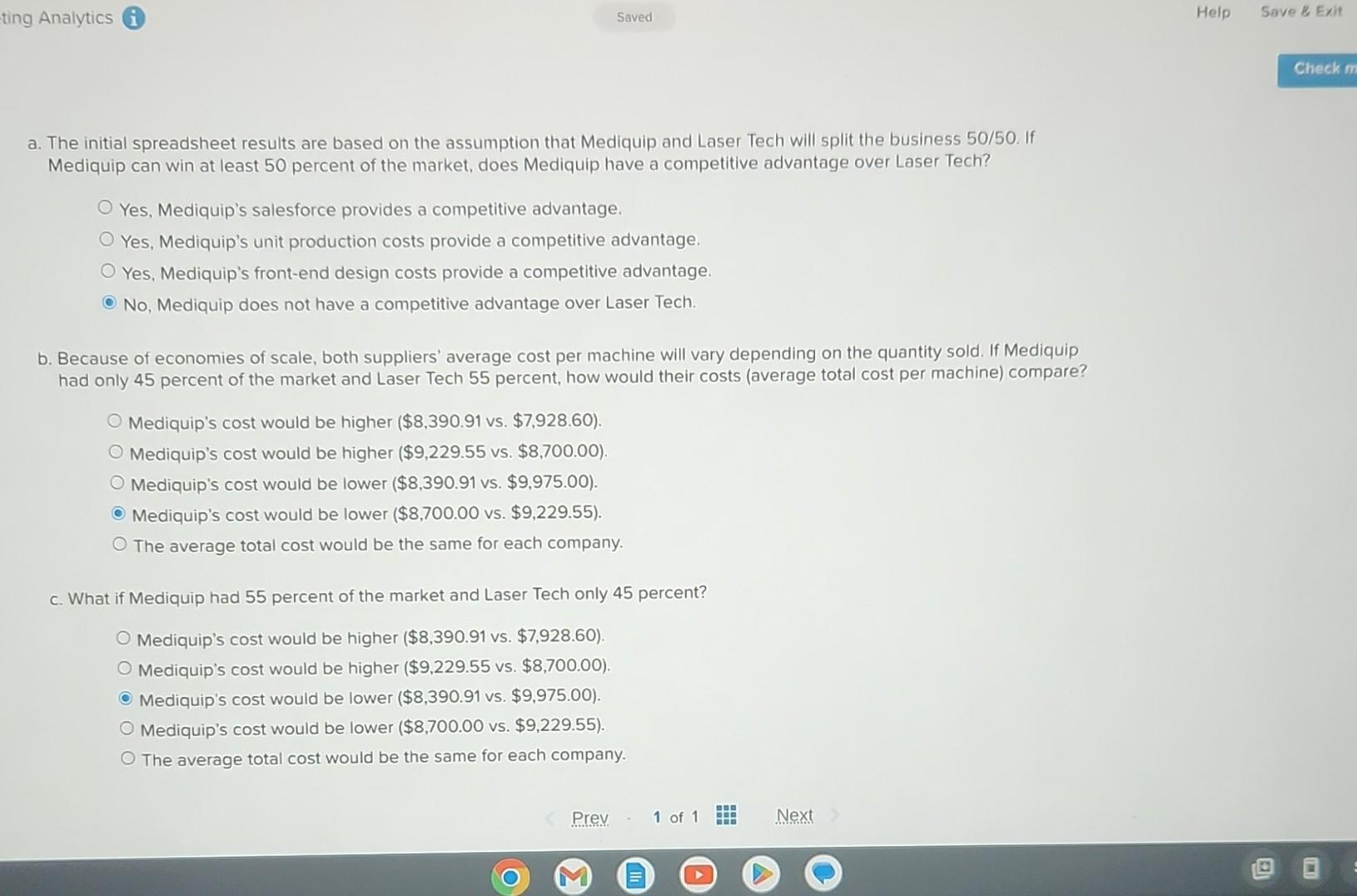

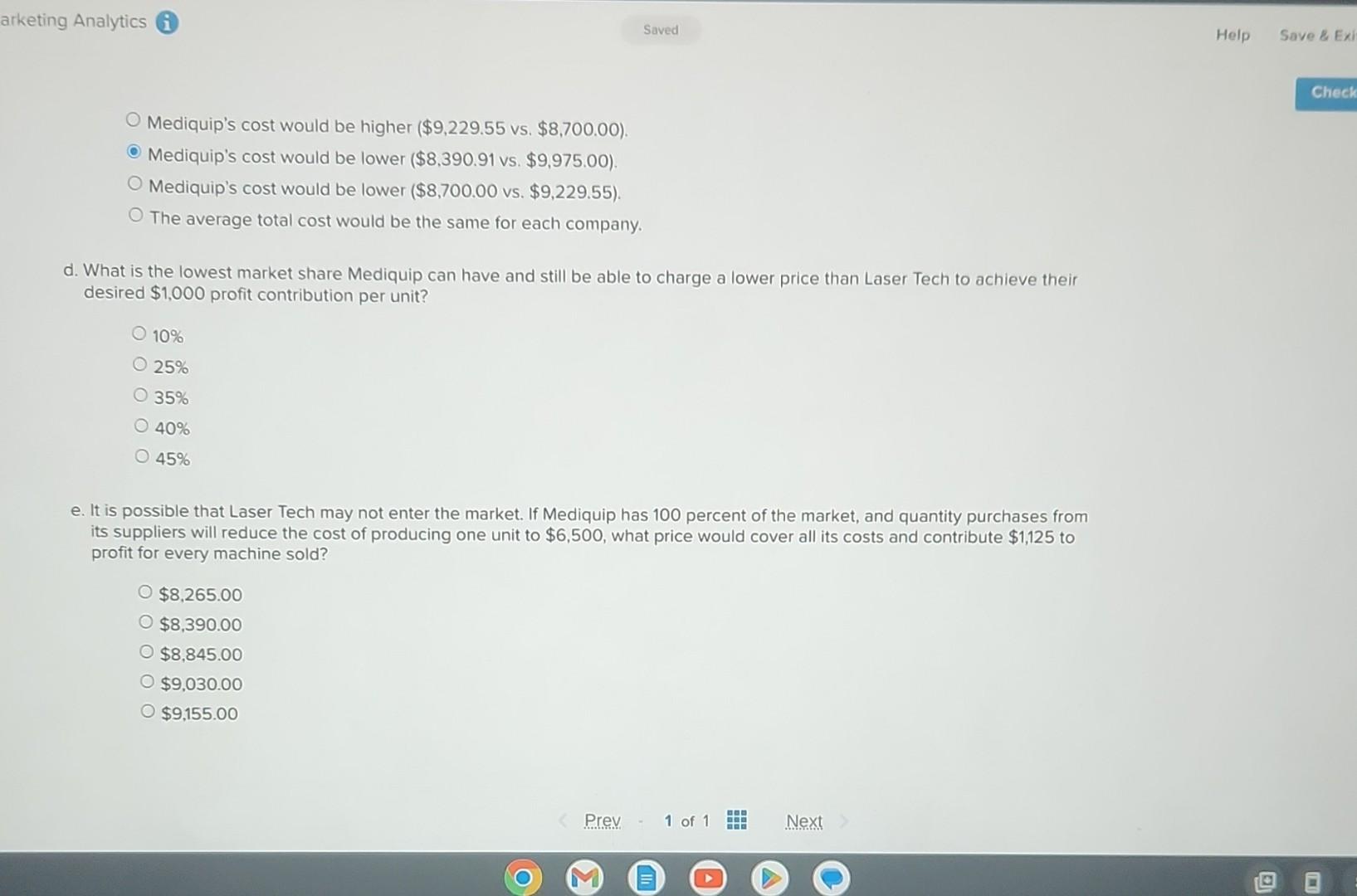

8. Marketing Analytics: Competitor Analysis Marketing Analytics: Competitor Analysis Instructions: Read the problem below and refer to the spreadsheet provided. The spreadsheet values highlighted in yellow can be manipulated in order to determine possible outcomes and answer the questions. You must answer the follow-up questions (a-e) correctly to receive full credit. Problem: Mediquip, Inc., produces medical equipment and uses its own sales force to sell the equipment to hospitals. Recently, several hospitals have asked Mediquip to develop a laser-beam "scalpel" for eye surgery. Mediquip has the needed resources, and 200 hospitals will probably buy the equipment. But Mediquip managers have heard that Laser Technologies-another quality producer-is thinking of competing for the same business. Mediquip has other good opportunities it could pursue-so it wants to see if it would have a competitive advantage over Laser Tech. Mediquip and Laser Tech are similar in most ways, but there are a few important differences. Laser Technologies already produces key parts that are needed for the new laser product-so its production costs would be lower. It would cost Mediquip more to design the product-and getting parts from outside suppliers would result in higher production costs. On the other hand, Mediquip has marketing strengths. It already has a good reputation with hospitals-and its sales force calls on only hospitals. Mediquip thinks that each of its current sales reps could spend some time selling the new product and that it could adjust sales territories so only four more sales reps would be needed for good coverage in the market. In contrast, Laser Tech's sales reps call on only industrial customers, so it would have to add 14 reps to cover the hospitals. Hospitals have budget pressures-so the supplier with the lowest price is likely to get a larger share of the business. But Mediquip knows that both suppliers' prices will be set high enough to cover the added costs of designing, producing, and selling the new Hospitals have budget pressures-so the supplier with the lowest price is likely to get a larger share of the business. But Mediquip knows that both suppliers' prices will be set high enough to cover the added costs of designing, producing, and selling the new product-and leave something for profit. Mediquip gathers information about its own likely costs and can estimate Laser Tech's costs from industry studies and Laser Tech's annual report. Mediquip has set up a spreadsheet to evaluate the proposed new product. Spreadsheet The spreadsheet values outlined in yellow can be changed in order to determine possible outcomes. You can find the initial values in the corresponding blue cells in columns E and F. Start by entering the initial values into columns B and C. Then review the questions below and adjust the values in columns B and C to determine the correct answers. Spreadsheet The spreadsheet values outlined in yellow can be changed in order to determine possible outcomes. You can find the initial values in the corresponding blue cells in columns E and F. Start by entering the initial values into columns B and C. Then review the questions below and adjust the values in columns B and C to determine the correct answers. a. The initial spreadsheet results are based on the assumption that Mediquip and Laser Tech will split the business 50/50. If Mediquip can win at least 50 percent of the market, does Mediquip have a competitive advantage over Laser Tech? Yes, Mediquip's salesforce provides a competitive advantage. Yes, Mediquip's unit production costs provide a competitive advantage. Yes, Mediquip's front-end design costs provide a competitive advantage. No, Mediquip does not have a competitive advantage over Laser Tech. b. Because of economies of scale, both suppliers' average cost per machine will vary depending on the quantity sold. If Mediquip had only 45 percent of the market and Laser Tech 55 percent, how would their costs (average total cost per machine) compare? Mediquip's cost would be higher ($8,390.91 vs. $7,928.60). Mediquip's cost would be higher ($9,229.55 vs. $8,700.00). Mediquip's cost would be lower ($8,390.91 vs. $9,975.00). Mediquip's cost would be lower ($8,700.00 vs. $9,229.55). The average total cost would be the same for each company. c. What if Mediquip had 55 percent of the market and Laser Tech only 45 percent? Mediquip's cost would be higher ( $8,390.91 vs. $7,928.60). Mediquip's cost would be higher ($9,229.55 vs. $8,700.00). Mediquip's cost would be lower ($8,390.91 vs. $9,975.00). Mediquip's cost would be lower ($8,700.00 vs. $9,229.55). The average total cost would be the same for each company. arketing Analytics i Mediquip's cost would be higher ($9,229.55 vs. $8,700.00). Mediquip's cost would be lower ($8,390.91 vs. $9,975.00). Mediquip's cost would be lower ($8,700.00 vs. $9,229.55). The average total cost would be the same for each company. d. What is the lowest market share Mediquip can have and still be able to charge a lower price than Laser Tech to achieve their desired $1,000 profit contribution per unit? 10% 25% 35% 40% 45% e. It is possible that Laser Tech may not enter the market. If Mediquip has 100 percent of the market, and quantity purchases from its suppliers will reduce the cost of producing one unit to $6,500, what price would cover all its costs and contribute $1,125 to profit for every machine sold? $8,265.00 $8,390.00 $8,845.00 $9,030.00 $9,155.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts