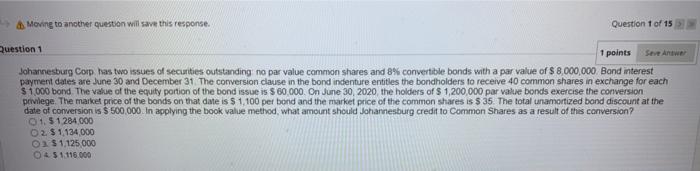

Question: 8. Moving to another question will save this response. Question 1 of 15 Question 1 1 points Johannesburg Corp has two issues of securities outstanding

8. Moving to another question will save this response. Question 1 of 15 Question 1 1 points Johannesburg Corp has two issues of securities outstanding no par value common shares and 8% convertible bonds with a par value of $ 8,000,000 Band interest payment dates are June 30 and December 31 The conversion clause in the bond indenture entities the bondholders to receive 40 common shares in exchange for each $1.000 bond. The value of the equity portion of the bond issue is $ 60.000. On June 30, 2020 the holders of $ 1,200,000 par value bonds exercise the conversion privilege. The market price of the bonds on that date is $ 1,100 per bond and the market price of the common shares is $35. The total unamortized bond discount at the date of conversion is $ 500.000. In applying the book value method what amount should Johannesburg credit to Common Shares as a result of this conversion? 0151284000 2. $1,134 000 O $1125 000 045 1116 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts