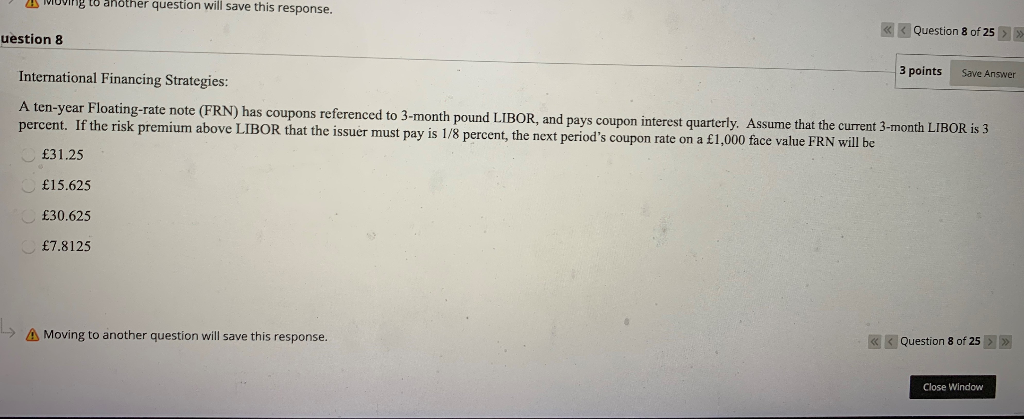

Question: 8 MUVIN to another question will save this response. >> Save Answer uestion 8 3 points International Financing Strategies: A ten-year Floating-rate note (FRN) has

8

MUVIN to another question will save this response. >> Save Answer uestion 8 3 points International Financing Strategies: A ten-year Floating-rate note (FRN) has coupons referenced to 3-month pound LIBOR, and pays coupon interest quarterly. Assume that the current 3-month LIBOR is 3 percent. If the risk premium above LIBOR that the issuer must pay is 1/8 percent, the next period's coupon rate on a 1,000 face value FRN will be 31.25 15.625 30.625 7.8125 A Moving to another question will save this response. >> Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts