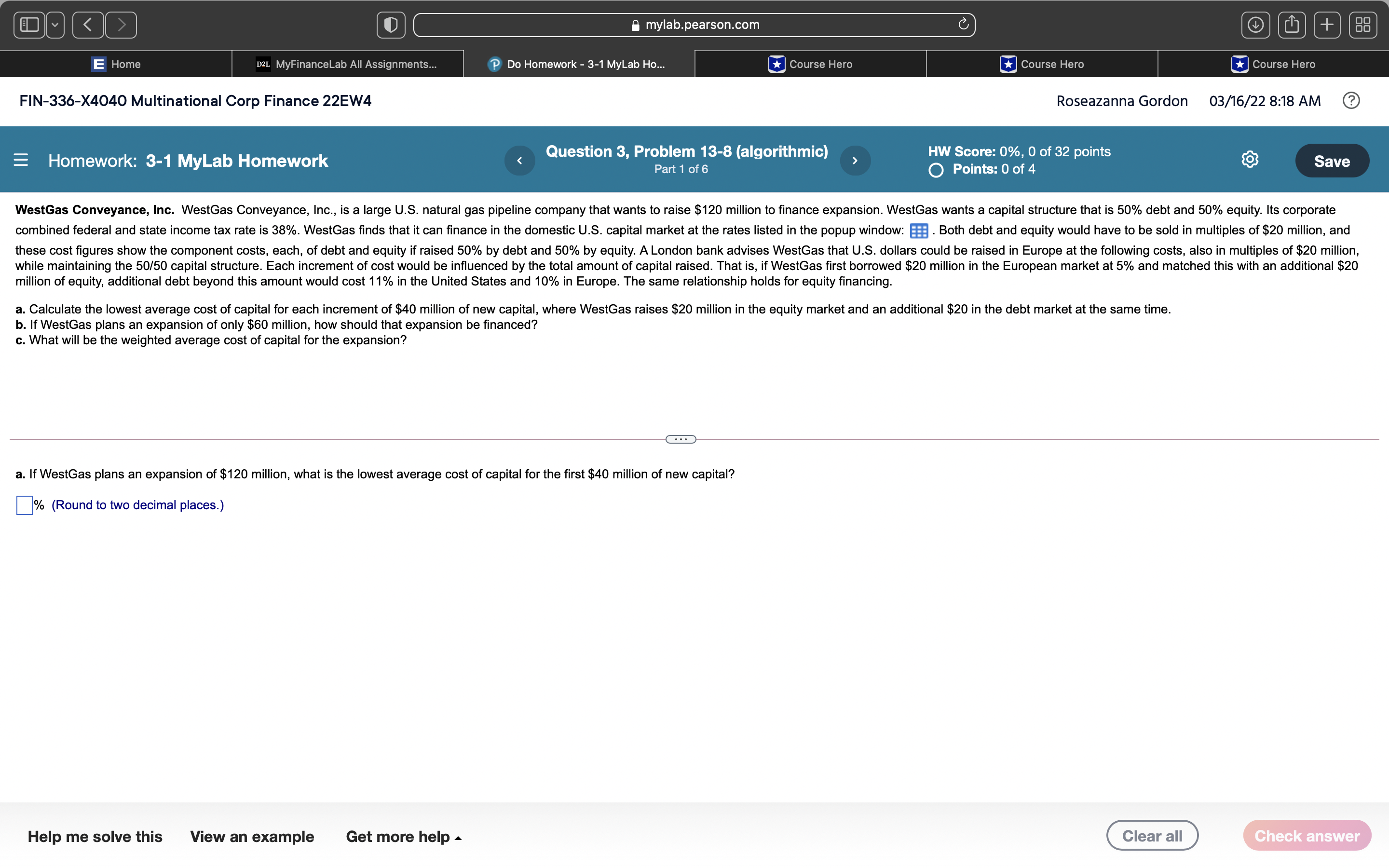

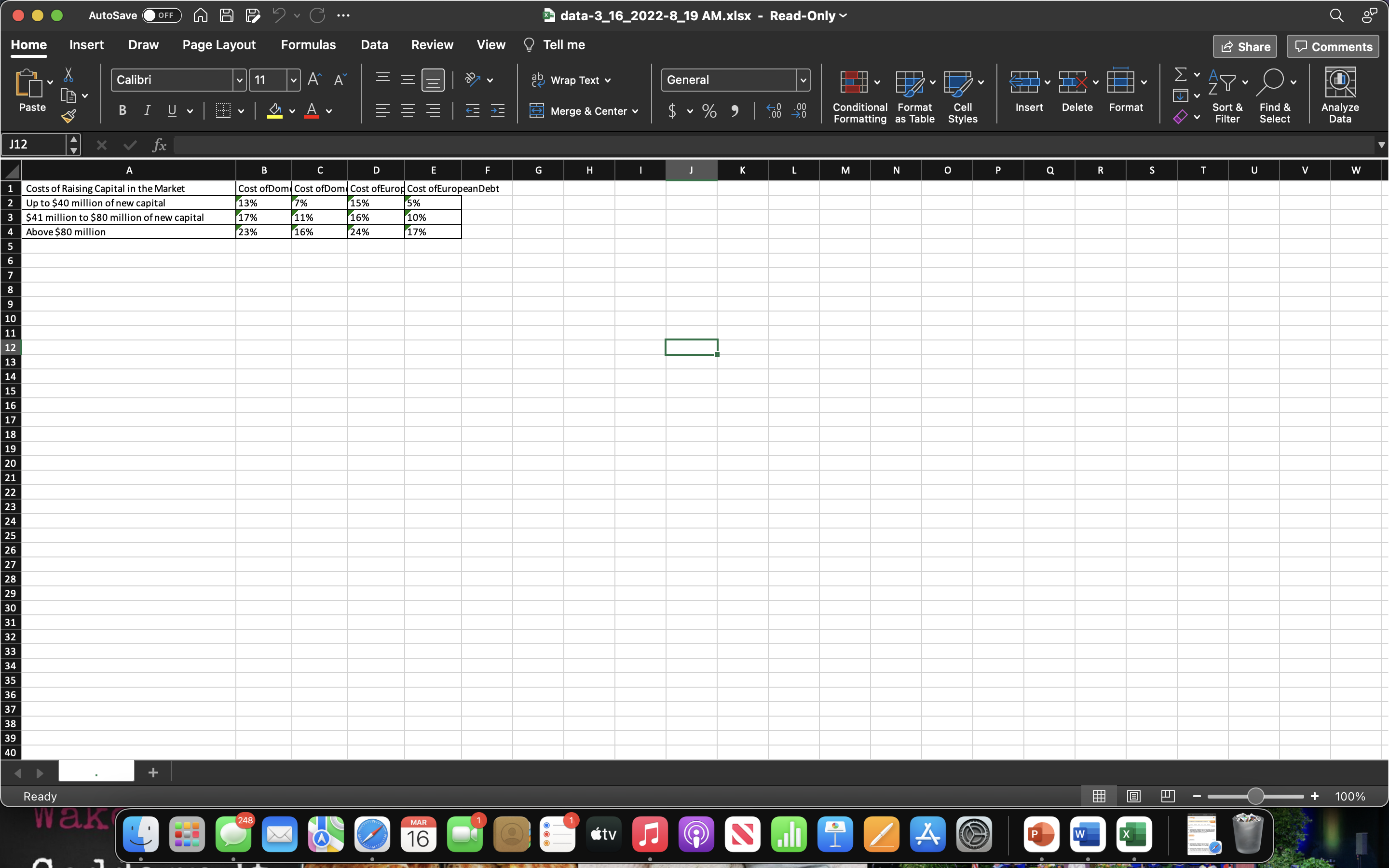

Question: 8 myla b.pearson.com 1) Do Homework - 31MyLab Ho... E FlN-336X4040 Multinational Corp Finance 22EW4 Roseazanna Gordon 03/16/22 8:18 AM ('3 Question 3, Problem 13-8

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock