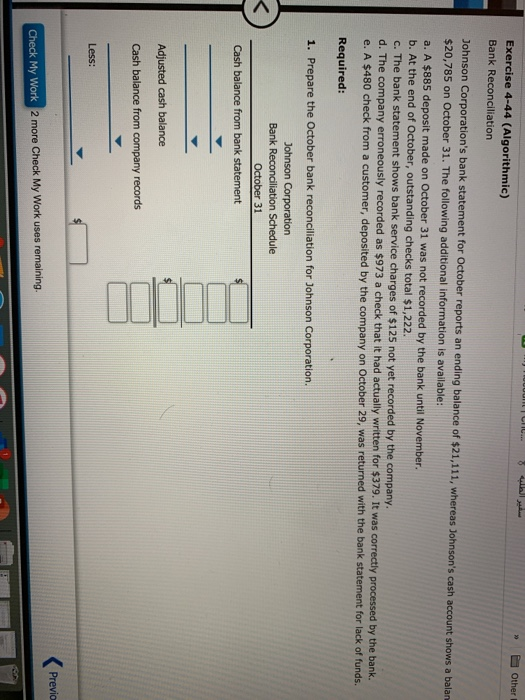

Question: ... 8 >> Other Exercise 4-44 (Algorithmic) Bank Reconciliation Johnson Corporation's bank statement for October reports an ending balance of $21,111, whereas Johnson's cash account

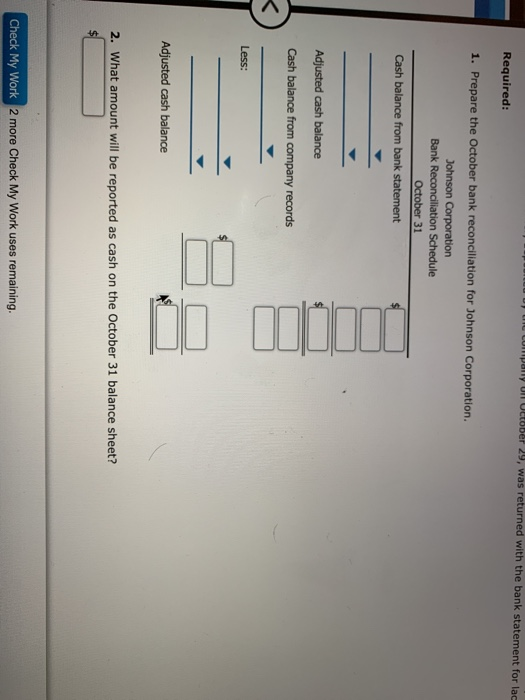

... 8 >> Other Exercise 4-44 (Algorithmic) Bank Reconciliation Johnson Corporation's bank statement for October reports an ending balance of $21,111, whereas Johnson's cash account shows a balan $20,785 on October 31. The following additional information is available: a. A $885 deposit made on October 31 was not recorded by the bank until November b. At the end of October, outstanding checks total $1,222. C. The bank statement shows bank service charges of $125 not yet recorded by the company. d. The company erroneously recorded as $973 a check that it had actually written for $379. It was correctly processed by the bank. e. A $480 check from a customer, deposited by the company on October 29, was returned with the bank statement for lack of funds. Required: 1. Prepare the October bank reconciliation for Johnson Corporation. Johnson Corporation Bank Reconciliation Schedule October 31 Cash balance from bank statement Adjusted cash balance Cash balance from company records Less: Previa Check My Work 2 more Check My Work uses remaining. Panon October 29, was returned with the bank statement for lag Required: 1. Prepare the October bank reconciliation for Johnson Corporation. Johnson Corporation Bank Reconciliation Schedule October 31 Cash balance from bank statement Adjusted cash balance Cash balance from company records Less: Adjusted cash balance 2. What amount will be reported as cash on the October 31 balance sheet? Check My Work 2 more Check My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts