Question: ( 8 points ) A financial analyst determines that Rainbow Company has $50 million of interest bearing debt outstanding and 4, 800, 000 common shares

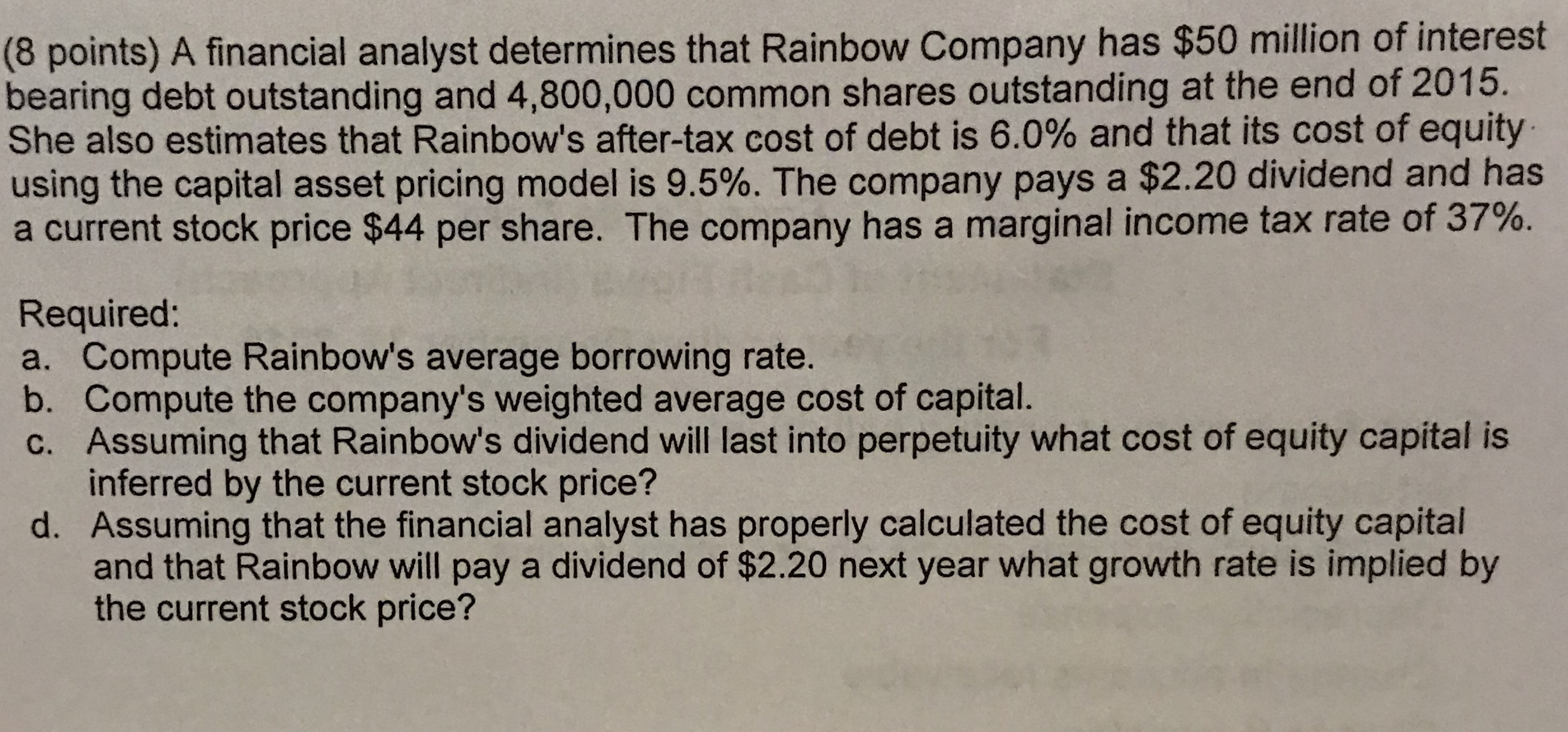

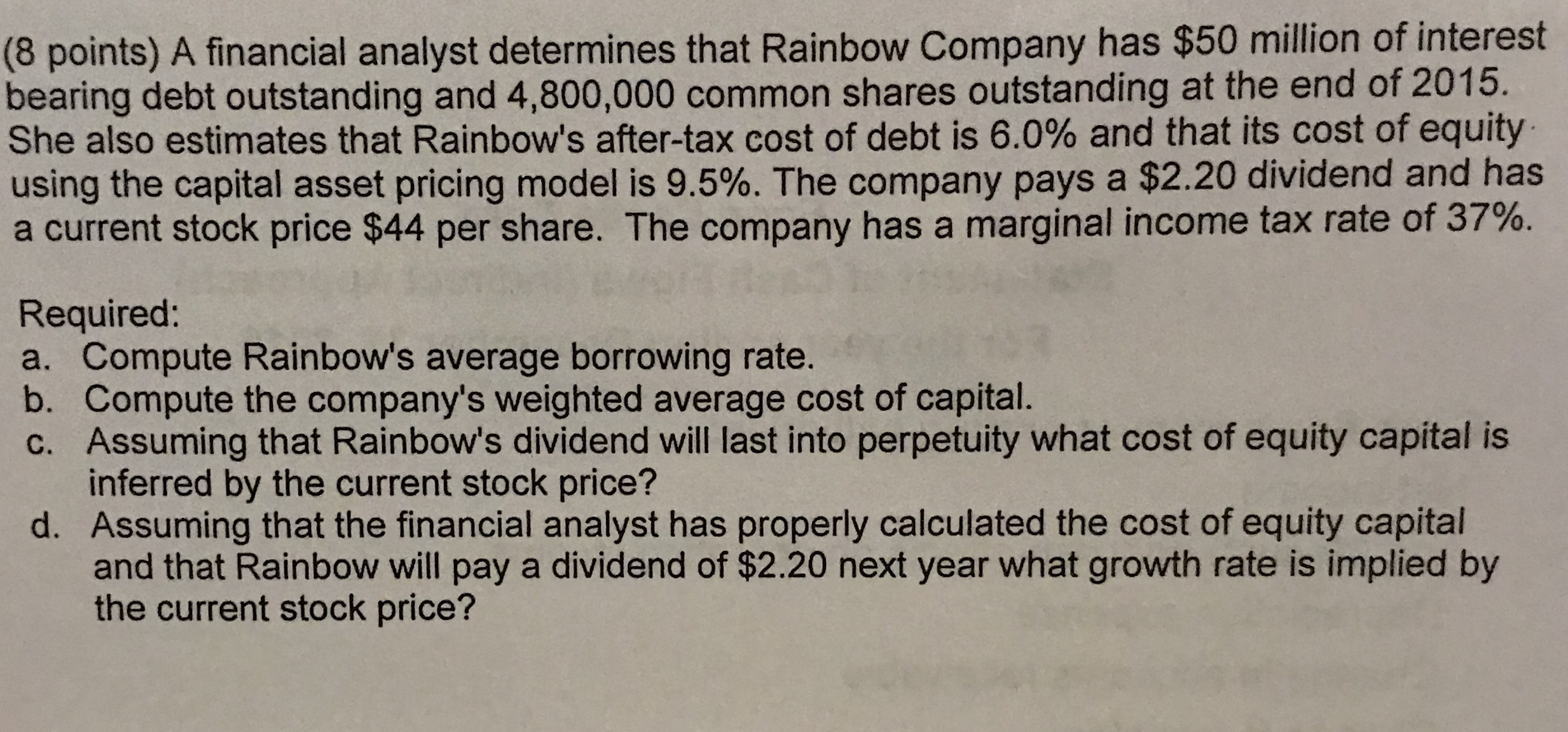

( 8 points ) A financial analyst determines that Rainbow Company has $50 million of interest bearing debt outstanding and 4, 800, 000 common shares outstanding at the end of 2015 She also estimates that Rainbow's after - tax cost of debt is 6.0% and that its cost of equity using the capital asset pricing model is 9.5% . The company pays a $2 . 20 dividend and has a current stock price $ 4 4 per share . The company has a marginal income tax rate of 37 % Required a . Compute Rainbow's average borrowing rate b . Compute the company's weighted average cost of capital C . Assuming that Rainbow's dividend will last into perpetuity what cost of equity capital is inferred by the current stock price ? 1 . Assuming that the financial analyst has properly calculated the cost of equity capital and that Rainbow will pay a dividend of $2 . 20 next year what growth rate is implied by the current stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts