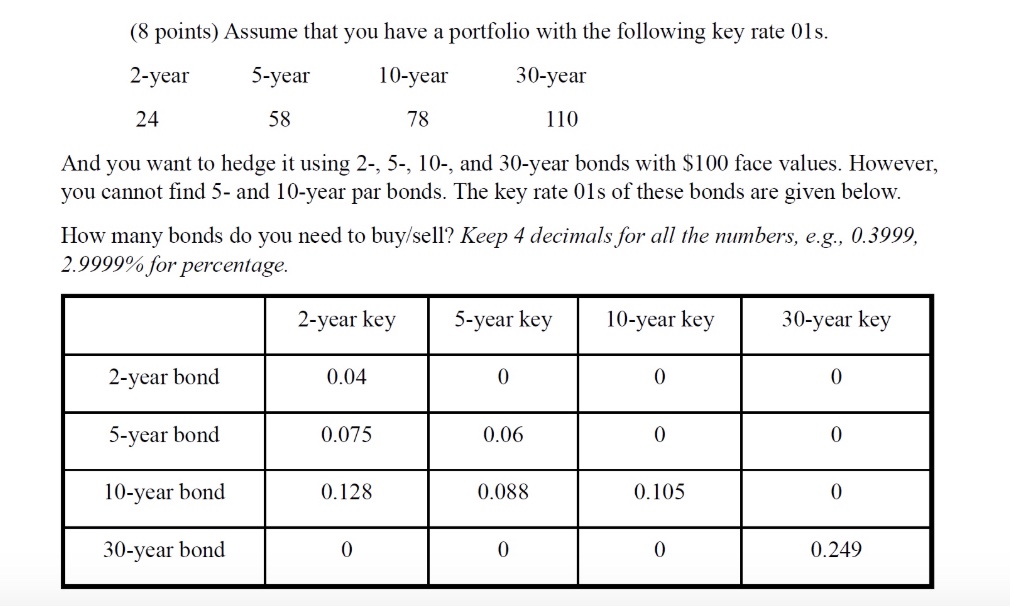

Question: ( 8 points ) Assume that you have a portfolio with the following key rate 0 1 s . begin { tabular } {

points Assume that you have a portfolio with the following key rate s begintabularccccyear & year & year & year & & & endtabular And you want to hedge it using and year bonds with $ face values. However, you cannot find and year par bonds. The key rate s of these bonds are given below. How many bonds do you need to buysell Keep decimals for all the numbers, eg for percentage. begintabularccccchline & year key & year key & year key & year key hline year bond & & & & hline year bond & & & & hline year bond & & & & hline year bond & & & & hline endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock