Question: (8 points) Principal Components is considering whether to lease or purchase some specialized equipment. The capital budgeting analysis indicating the equipment should be secured already

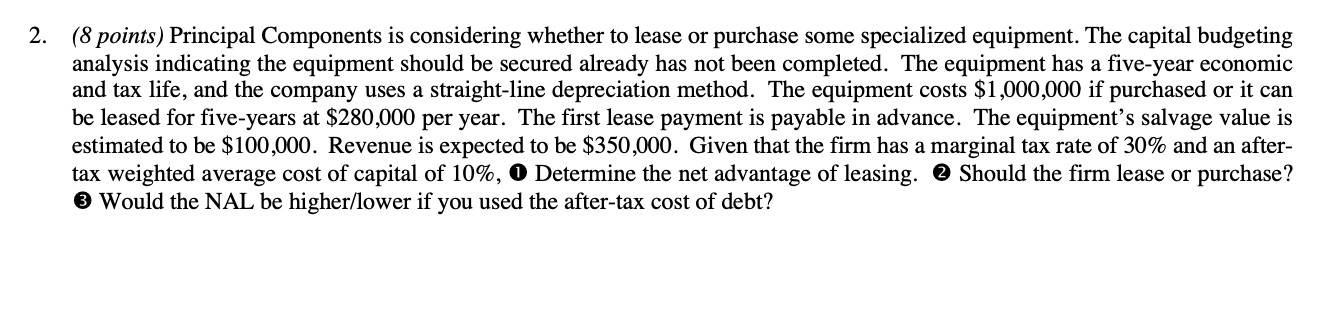

(8 points) Principal Components is considering whether to lease or purchase some specialized equipment. The capital budgeting analysis indicating the equipment should be secured already has not been completed. The equipment has a five-year economic and tax life, and the company uses a straight-line depreciation method. The equipment costs $1,000,000 if purchased or it can be leased for five-years at $280,000 per year. The first lease payment is payable in advance. The equipment's salvage value is estimated to be $100,000. Revenue is expected to be $350,000. Given that the firm has a marginal tax rate of 30% and an aftertax weighted average cost of capital of 10%, (1) Determine the net advantage of leasing. (2 Should the firm lease or purchase? 3 Would the NAL be higher/lower if you used the after-tax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts