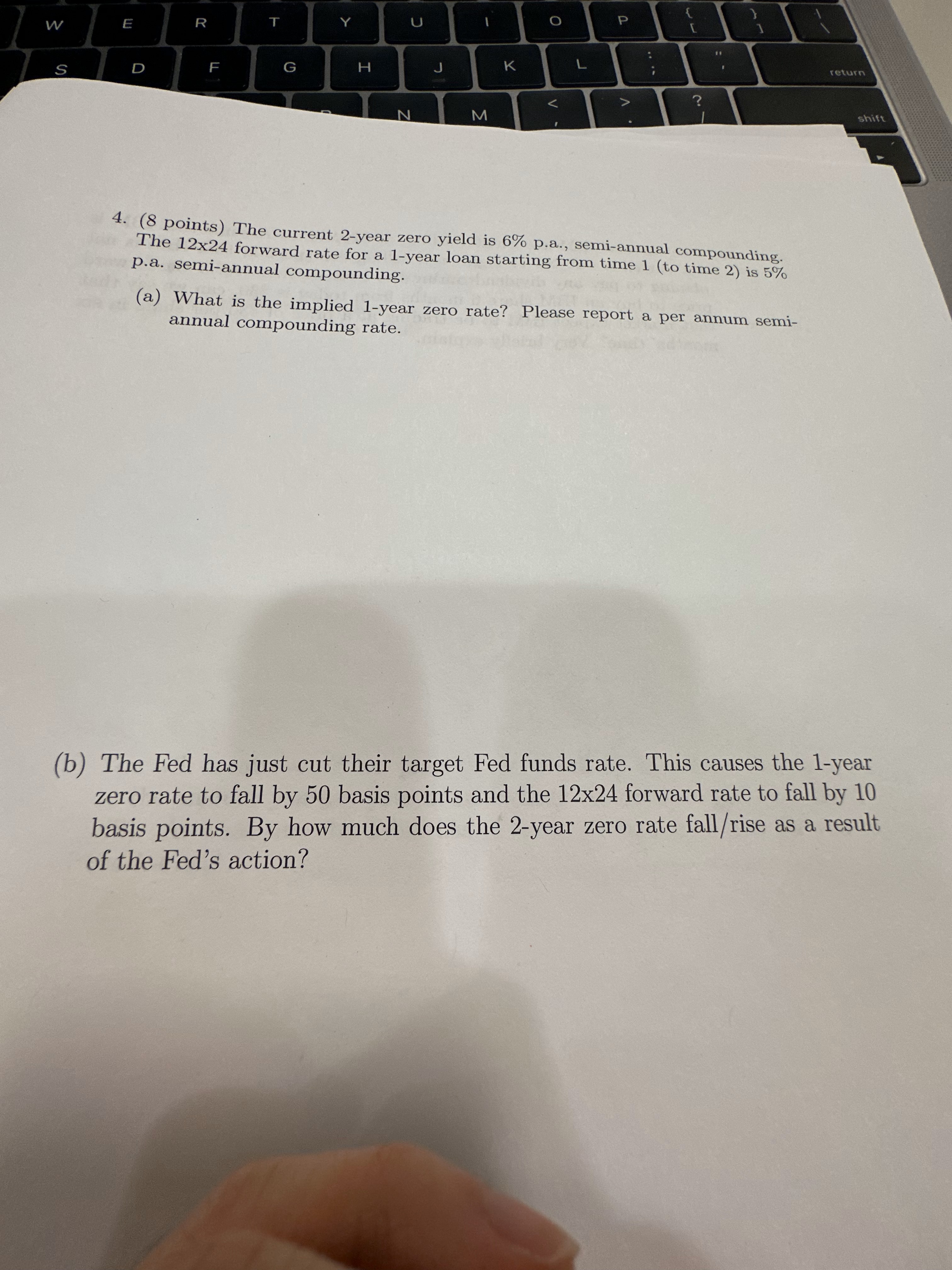

Question: ( 8 points ) The current 2 - year zero yield is 6 % p . a . , semi - annual compounding. The 1

points The current year zero yield is pa semiannual compounding.

The forward rate for a year loan starting from time to time is

pa semiannual compounding.

a What is the implied year zero rate? Please report a per annum semi

annual compounding rate.

b The Fed has just cut their target Fed funds rate. This causes the year

zero rate to fall by basis points and the forward rate to fall by

basis points. By how much does the year zero rate fallrise as a result

of the Fed's action?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock