Question: 8 Problem 12-16 CAPM and Expected Return (LO2) A share of stock with a beta of 0.75 now sells for $50. Investors expect the stock

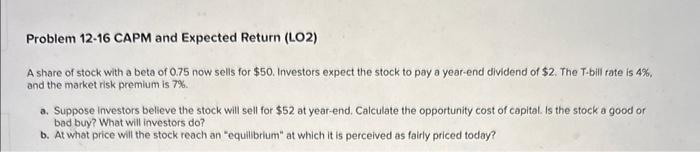

Problem 12-16 CAPM and Expected Return (LO2) A share of stock with a beta of 0.75 now sells for $50. Investors expect the stock to pay a year-end dividend of $2. The T.bill fate is 4%, and the market risk premium is 7%. a. Suppose investors believe the stock will sell for $52 at year-end. Calculate the opportunity cost of capital. Is the stock a good or bad buy? What will investors do? b. At what price will the stock reach an "equilbrium" at which it is perceived as fairly priced today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts