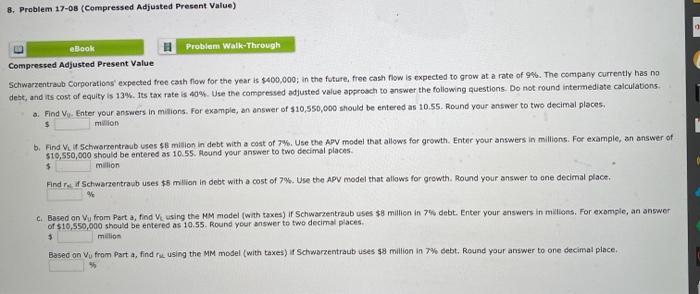

Question: 8. Problem 17-08 Compressed Adjusted Present Value) eBook Problem Walk Through Compressed Adjusted Present Value Schwarzentraub Corporations' expected free cash flow for the year is

8. Problem 17-08 Compressed Adjusted Present Value) eBook Problem Walk Through Compressed Adjusted Present Value Schwarzentraub Corporations' expected free cash flow for the year is $400,000, in the future, free cash flow is expected to grow at a rate of 9%. The company currently has no debt, and its cost of equity is 13%. Its tax rate is 10%. Use the compressed adjusted value approach to answer the following questions. Do not round intermediate calculations a. Find Vy. Enter your answers in milions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. milion b. Find V. Schwarrentraub uses $8 million in debt with a cost of 7%. Use the APV model that allows for growth. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Hound your answer to two decimal places $ million Find Schwarzentraub uses $5 million in debt with a cost of 7%. Use the APV model that allows for growth. Round your answer to one decimal place C. Based on Vy from Part a, find V using the MM model (with taxes) ir Schwarzentraub uses $8 million in 7% debt. Enter your answers in milions. For exemple, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. million 3 Based on Vy from Part a, find using the MM model (with taxes) Schwarzentraub uses $8 million in 7% debt. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts