Question: 8. Problem 7.06 (Bond Valuation) eBook Problem Walk-Through An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in

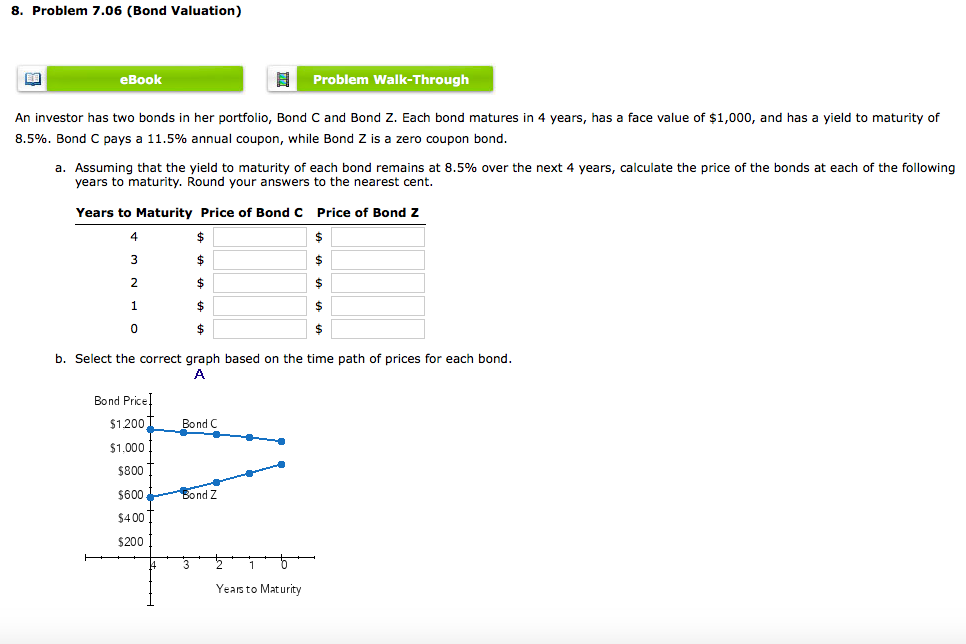

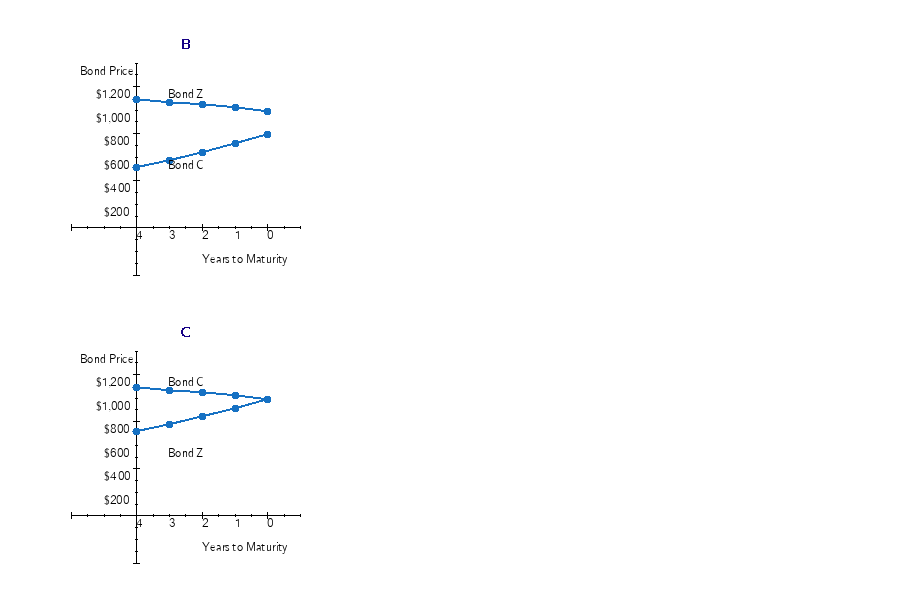

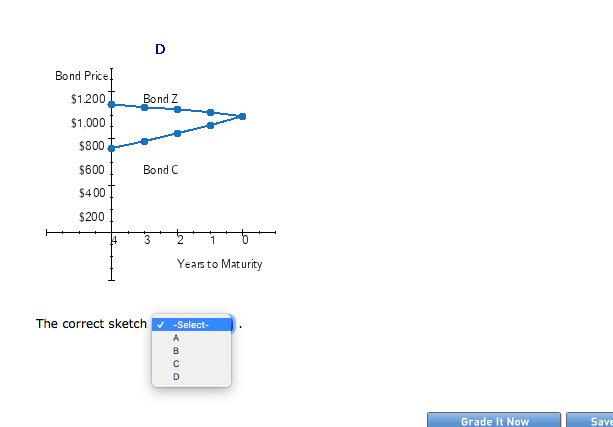

8. Problem 7.06 (Bond Valuation) eBook Problem Walk-Through An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.5%. Bond C pays a 11.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.5% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z b. Select the correct graph based on the time path of prices for each bond. Bond Price $1.2001 $1.000 Bond $800 $600 Bond Z $400 $200 Years to Maturity Bond Price! $12001 $1.000 Bond Z $8007 Sond $600 $400 $200 Years to Maturity Bond Price $12001 $1.000 Bond 5800 $6001 Bond Z $4007 $200 Years to Maturity Bond Price! $1200T $1.000 Bond Z Bond C $800 + $6001 $4001 $200 Years to Maturity The correct sketch -Select- Grade It Now Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts