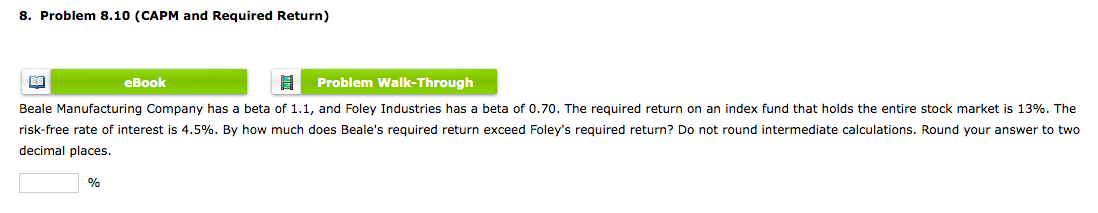

Question: 8. Problem 8.10 (CAPM and Required Return) Beale Manufacturing Company has a beta of 1.1 , and Foley Industries has a beta of 0.70 .

8. Problem 8.10 (CAPM and Required Return) Beale Manufacturing Company has a beta of 1.1 , and Foley Industries has a beta of 0.70 . The required return on an index fund that holds the entire stock mark 13%. The risk-free rate of interest is 4.5%. By how much does Beale's required return exceed Foley's required return? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts