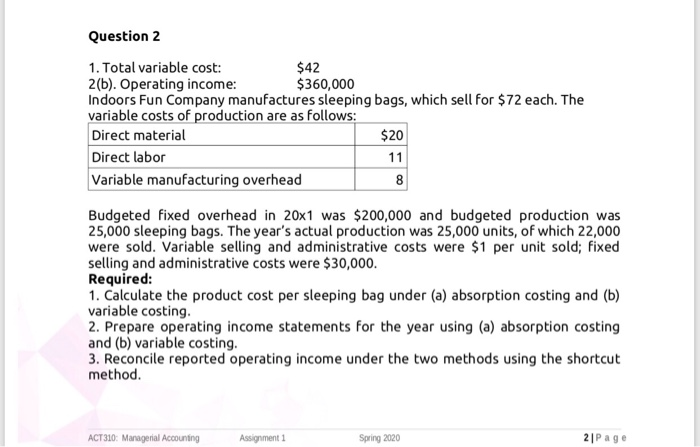

Question: 8 Question 2 1. Total variable cost: $42 2(b). Operating income: $360,000 Indoors Fun Company manufactures sleeping bags, which sell for $72 each. The variable

8 Question 2 1. Total variable cost: $42 2(b). Operating income: $360,000 Indoors Fun Company manufactures sleeping bags, which sell for $72 each. The variable costs of production are as follows: Direct material $20 Direct labor 11 Variable manufacturing overhead Budgeted fixed overhead in 20x1 was $200,000 and budgeted production was 25,000 sleeping bags. The year's actual production was 25,000 units, of which 22,000 were sold. Variable selling and administrative costs were $1 per unit sold; fixed selling and administrative costs were $30,000. Required: 1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing. 2. Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. 3. Reconcile reported operating income under the two methods using the shortcut method. ACT310: Managerial Accounting Assignment1 Spring 2020 21 Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts