Question: 8- Receipts which do not create a liability for the govt or do not lead to reduction in assets are known a a. Capital

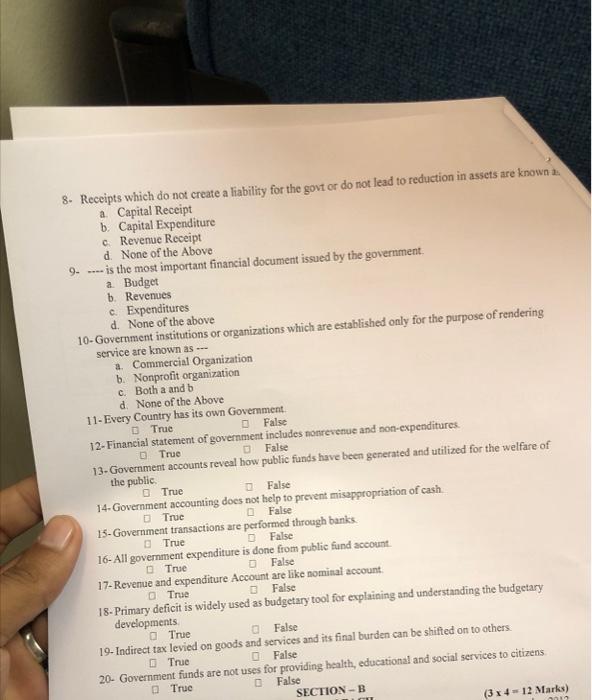

8- Receipts which do not create a liability for the govt or do not lead to reduction in assets are known a a. Capital Receipt b. Capital Expenditure c. Revenue Receipt d. None of the Above 9-is the most important financial document issued by the government, a. Budget b. Revenues c. Expenditures d. None of the above 10-Government institutions or organizations which are established only for the purpose of rendering service are known as --- a. Commercial Organization b. Nonprofit organization c. Both a and b d. None of the Above 11-Every Country has its own Government True False 12-Financial statement of government includes nonrevenue and non-expenditures. O True False 13-Government accounts reveal how public funds have been generated and utilized for the welfare of the public. True False 14-Government accounting does not help to prevent misappropriation of cash. True 15-Government transactions are performed through banks True False False 16-All government expenditure is done from public fund account. True False 17-Revenue and expenditure Account are like nominal account. True False 18-Primary deficit is widely used as budgetary tool for explaining and understanding the budgetary developments. True False 19-Indirect tax levied on goods and services and its final burden can be shifted on to others. True 20- Government funds are not uses for providing health, educational and social services to citizens. True False False SECTION-B (3x4-12 Marks) 0012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts