Question: 8% Section B Attempt TWO questions only from this section. Question 4 (a) Credit risk of a bond can be straightforwardly estimated. Discuss. (7 marks)

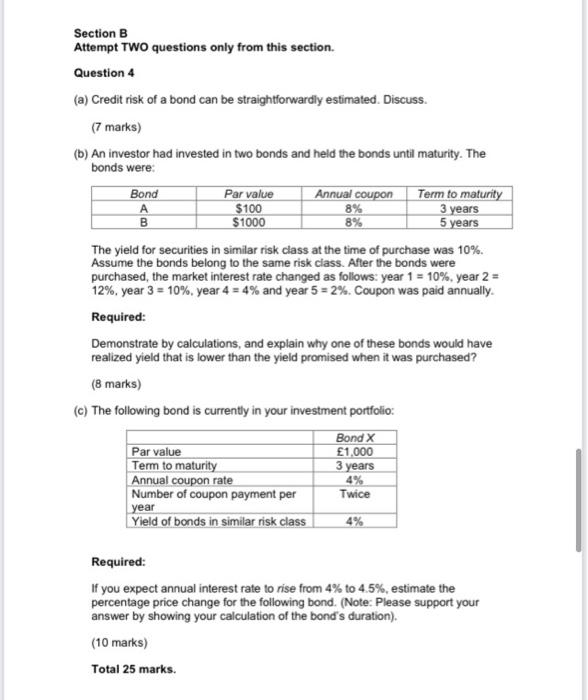

8% Section B Attempt TWO questions only from this section. Question 4 (a) Credit risk of a bond can be straightforwardly estimated. Discuss. (7 marks) (b) An investor had invested in two bonds and held the bonds until maturity. The bonds were: Bond Par value Annual coupon Term to maturity A $100 3 years B $1000 8% The yield for securities in similar risk class at the time of purchase was 10%. Assume the bonds belong to the same risk class. After the bonds were purchased the market interest rate changed as follows: year 1 = 10%, year 2 = 12%, year 3 = 10%. year 4 = 4% and year 5 = 2%. Coupon was paid annually. Required: Demonstrate by calculations, and explain why one of these bonds would have realized yield that is lower than the yield promised when it was purchased? (8 marks) (c) The following bond is currently in your investment portfolio: 5 years Par value Term to maturity Annual coupon rate Number of coupon payment per year Yield of bonds in similar risk class Bond X 1.000 3 years 4% Twice Required: If you expect annual interest rate to rise from 4% to 4.5%, estimate the percentage price change for the following bond. (Note: Please support your answer by showing your calculation of the bond's duration). (10 marks) Total 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts