Question: 8. Tests of the CAPM Aa Aa E The CAPM is one of the most extensively tested models in finance. The following statements describe the

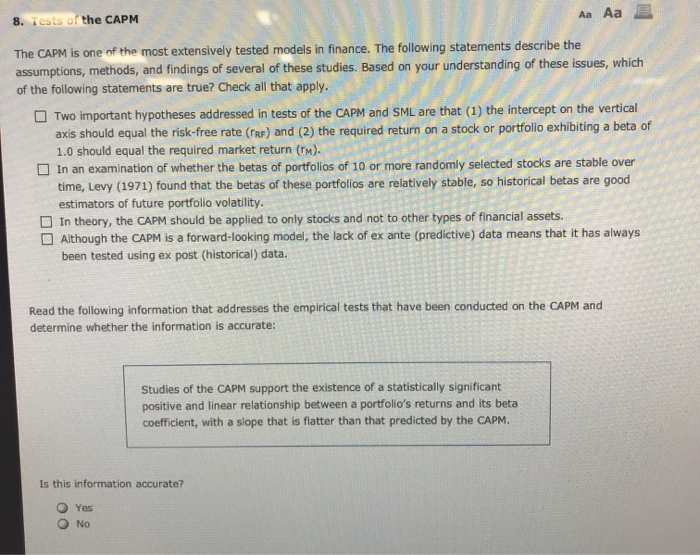

8. Tests of the CAPM Aa Aa E The CAPM is one of the most extensively tested models in finance. The following statements describe the assumptions, methods, and findings of several of these studies. Based on your understanding of these issues, which of the following statements are true? Check all that apply. Two important hypotheses addressed in tests of the CAPM and SML are that (1) the intercept on the vertical axis should equal the risk-free rate (FRP) and (2) the required return on a stock or portfolio exhibiting a beta of 1.0 should equal the required market return (nm). In an examination of whether the betas of portfolios of 10 or more randomly selected stocks are stable over time, Levy (1971) found that the betas of these portfolios are relatively stable, so historical betas are good estimators of future portfolio volatility. In theory, the CAPM should be applied to only stocks and not to other types of financial assets. Although the CAPM is a forward-looking model, the lack of ex ante (predictive) data means that it has always been tested using ex post (historical) data. Read the following information that addresses the empirical tests that have been conducted on the CAPM and determine whether the information is accurate: Studies of the CAPM support the existence of a statistically significant positive and linear relationship between a portfolio's returns and its beta coefficient, with a slope that is flatter than that predicted by the CAPM. Is this information accurate? O Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts