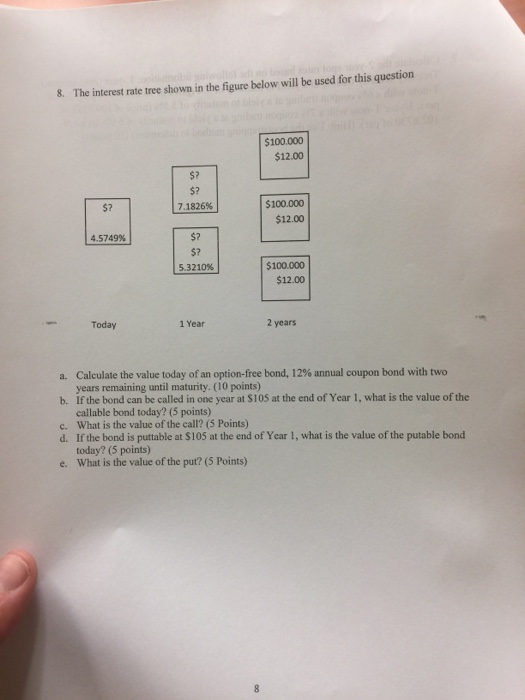

Question: 8. The interest rate tree shown in the figure below will be used for this question $100.000 $12.00 $100.000 $12.00 7.1826% 4.5749% 100.000 $12.00 5.3210%

8. The interest rate tree shown in the figure below will be used for this question $100.000 $12.00 $100.000 $12.00 7.1826% 4.5749% 100.000 $12.00 5.3210% Today 1 Year 2 years Calculate the value today of an option-free bond, 12% annual coupon bond with two years remaining until maturity. (10 points) If the bond can be called in one year at $105 at the end of Year 1, what is the value of the callable bond today? (5 points) What is the value of the call? (5 Points) If the bond is puttable at $105 at the end of Year 1, what is the value of the putable bond today? (5 points) What is the value of the put? (5 Points) a. b. c. d. e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock