Question: 8) Under the full absorption costing system, what is the primary reason for the difference in profits between producing 50,000 units and producing 100,000 units

8) Under the full absorption costing system, what is the primary reason for the difference in profits between producing 50,000 units and producing 100,000 units while holding constant sales at 50,000 units?

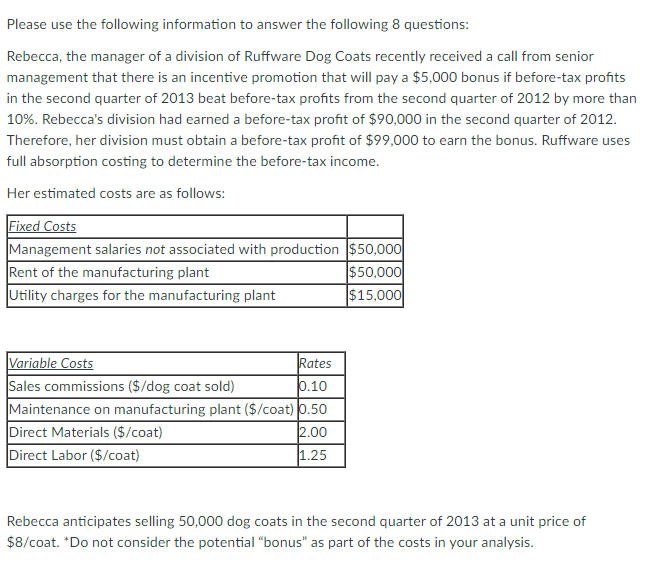

Please use the following information to answer the following 8 questions: Rebecca, the manager of a division of Ruffware Dog Coats recently received a call from senior management that there is an incentive promotion that will pay a $5,000 bonus if before-tax profits in the second quarter of 2013 beat before-tax profits from the second quarter of 2012 by more than 10%. Rebecca's division had earned a before-tax profit of $90,000 in the second quarter of 2012. Therefore, her division must obtain a before-tax profit of $99,000 to earn the bonus. Ruffware uses full absorption costing to determine the before-tax income. Her estimated costs are as follows: Fixed Costs Management salaries not associated with production $50,000 Rent of the manufacturing plant $50,000 Utility charges for the manufacturing plant $15,000 Variable Costs Rates Sales commissions ($/dog coat sold) 10.10 Maintenance on manufacturing plant ($/coat) 0.50 Direct Materials ($/coat) 2.00 Direct Labor ($/coat) 1.25 Rebecca anticipates selling 50,000 dog coats in the second quarter of 2013 at a unit price of $8/coat. *Do not consider the potential "bonus" as part of the costs in your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts