Question: 8) Using the information provided in problem 7, assume that the underwriter is granted a 15% overallotment option. The underwriter issues shares backed by the

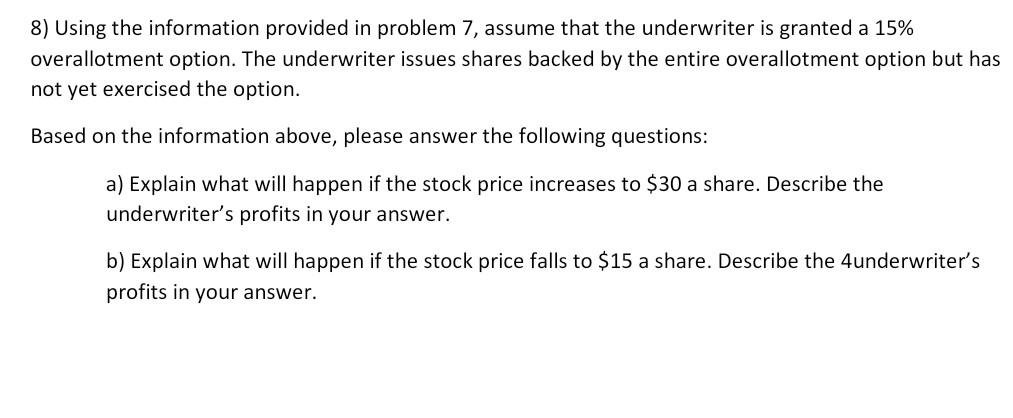

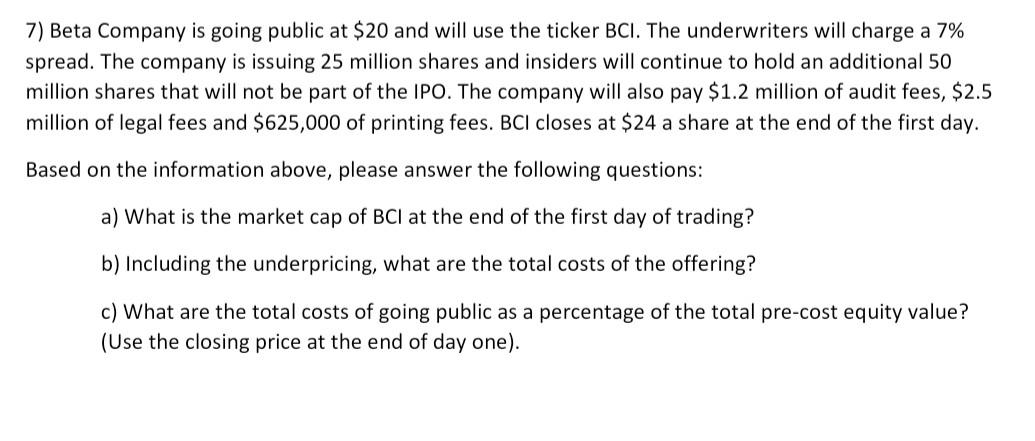

8) Using the information provided in problem 7, assume that the underwriter is granted a 15% overallotment option. The underwriter issues shares backed by the entire overallotment option but has not yet exercised the option. Based on the information above, please answer the following questions: a) Explain what will happen if the stock price increases to $30 a share. Describe the underwriter's profits in your answer. b) Explain what will happen if the stock price falls to $15 a share. Describe the 4 underwriter's profits in your answer. 7) Beta Company is going public at $20 and will use the ticker BCl. The underwriters will charge a 7% spread. The company is issuing 25 million shares and insiders will continue to hold an additional 50 million shares that will not be part of the IPO. The company will also pay $1.2 million of audit fees, \$2.5 million of legal fees and $625,000 of printing fees. BCl closes at $24 a share at the end of the first day. Based on the information above, please answer the following questions: a) What is the market cap of BCl at the end of the first day of trading? b) Including the underpricing, what are the total costs of the offering? c) What are the total costs of going public as a percentage of the total pre-cost equity value? (Use the closing price at the end of day one). 8) Using the information provided in problem 7, assume that the underwriter is granted a 15% overallotment option. The underwriter issues shares backed by the entire overallotment option but has not yet exercised the option. Based on the information above, please answer the following questions: a) Explain what will happen if the stock price increases to $30 a share. Describe the underwriter's profits in your answer. b) Explain what will happen if the stock price falls to $15 a share. Describe the 4 underwriter's profits in your answer. 7) Beta Company is going public at $20 and will use the ticker BCl. The underwriters will charge a 7% spread. The company is issuing 25 million shares and insiders will continue to hold an additional 50 million shares that will not be part of the IPO. The company will also pay $1.2 million of audit fees, \$2.5 million of legal fees and $625,000 of printing fees. BCl closes at $24 a share at the end of the first day. Based on the information above, please answer the following questions: a) What is the market cap of BCl at the end of the first day of trading? b) Including the underpricing, what are the total costs of the offering? c) What are the total costs of going public as a percentage of the total pre-cost equity value? (Use the closing price at the end of day one)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts