Question: 8. What does a correlation coefficient of 0.76 between two assets indicate? (1 point) Only one of the assets is profitable. As one asset increases,

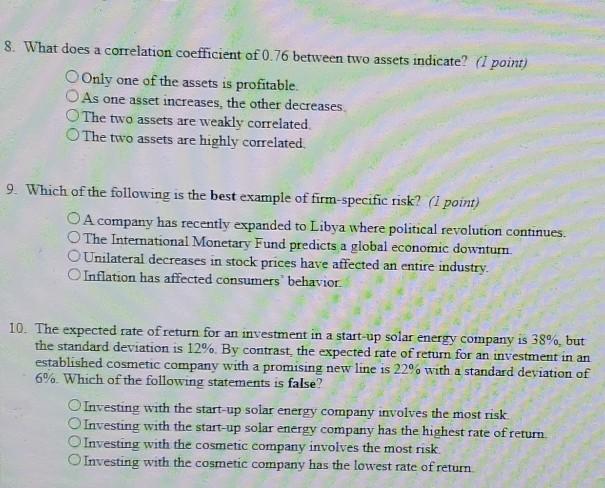

8. What does a correlation coefficient of 0.76 between two assets indicate? (1 point) Only one of the assets is profitable. As one asset increases, the other decreases The two assets are weakly correlated The two assets are highly correlated 9. Which of the following is the best example of firm-specific risk? (1 point) A company has recently expanded to Libya where political revolution continues. The International Monetary Fund predicts a global economic downtum O Unilateral decreases in stock prices have affected an entire industry. Inflation has affected consumers behavior. 10. The expected rate of return for an investment in a start-up solar energy company is 38%, but the standard deviation is 12%. By contrast, the expected rate of return for an investment in an established cosmetic company with a promising new line is 22% with a standard deviation of 6%. Which of the following statements is false? O Investing with the start-up solar energy company involves the most risk Investing with the start-up solar energy company has the highest rate of return Investing with the cosmetic company involves the most risk Investing with the cosmetic company has the lowest rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts