Question: 8. Worldwide Widget Manufacturing, Inc., is preparing to launch a new manufacturing facility in a new location. The company has a capital structure that consists

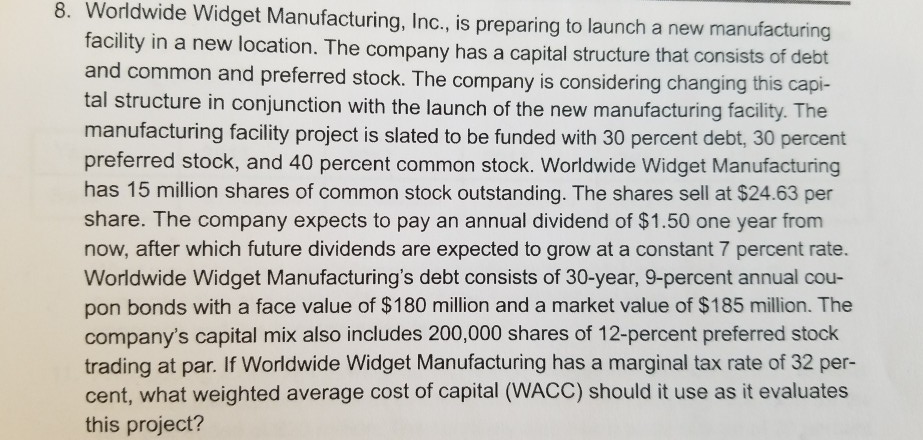

8. Worldwide Widget Manufacturing, Inc., is preparing to launch a new manufacturing facility in a new location. The company has a capital structure that consists of debt and common and preferred stock. The company is considering changing this capi- tal structure in conjunction with the launch of the new manufacturing facility. The manufacturing facility project is slated to be funded with 30 percent debt, 30 percent preferred stock, and 40 percent common stock. Worldwide Widget Manufacturing has 15 million shares of common stock outstanding. The shares sell at $24.63 per share. The company expects to pay an annual dividend of $1.50 one year from now, after which future dividends are expected to grow at a constant 7 percent rate. Worldwide Widget Manufacturing's debt consists of 30-year, 9-percent annual cou- pon bonds with a face value of $180 million and a market value of $185 million. The company's capital mix also includes 200,000 shares of 12-percent preferred stock trading at par. If Worldwide Widget Manufacturing has a marginal tax rate of 32 per- cent, what weighted average cost of capital (WACC) should it use as it evaluates this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts