Question: 8. You are only given five financial instruments in this question: European call and European put options, two types of zero-coupon bonds and a stock.

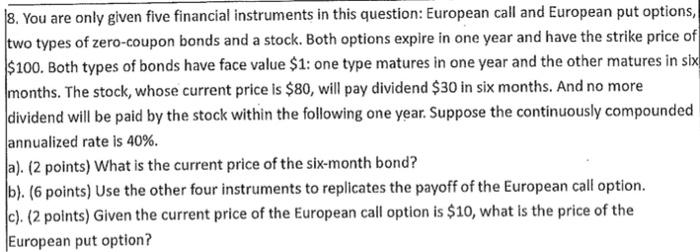

8. You are only given five financial instruments in this question: European call and European put options, two types of zero-coupon bonds and a stock. Both options expire in one year and have the strike price of $100. Both types of bonds have face value $1: one type matures in one year and the other matures in six months. The stock, whose current price is $80, will pay dividend $30 in six months. And no more dividend will be paid by the stock within the following one year. Suppose the continuously compounded annualized rate is 40%. a). (2 points) What is the current price of the six-month bond? b). (6 points) Use the other four instruments to replicates the payoff of the European call option. c). (2 points) Given the current price of the European call option is $10, what is the price of the European put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts