Question: 8. You have been asked to value The Skyfall, a privately owned restaurant that generated $ 150,000 in after-tax operating income on $ 1 million

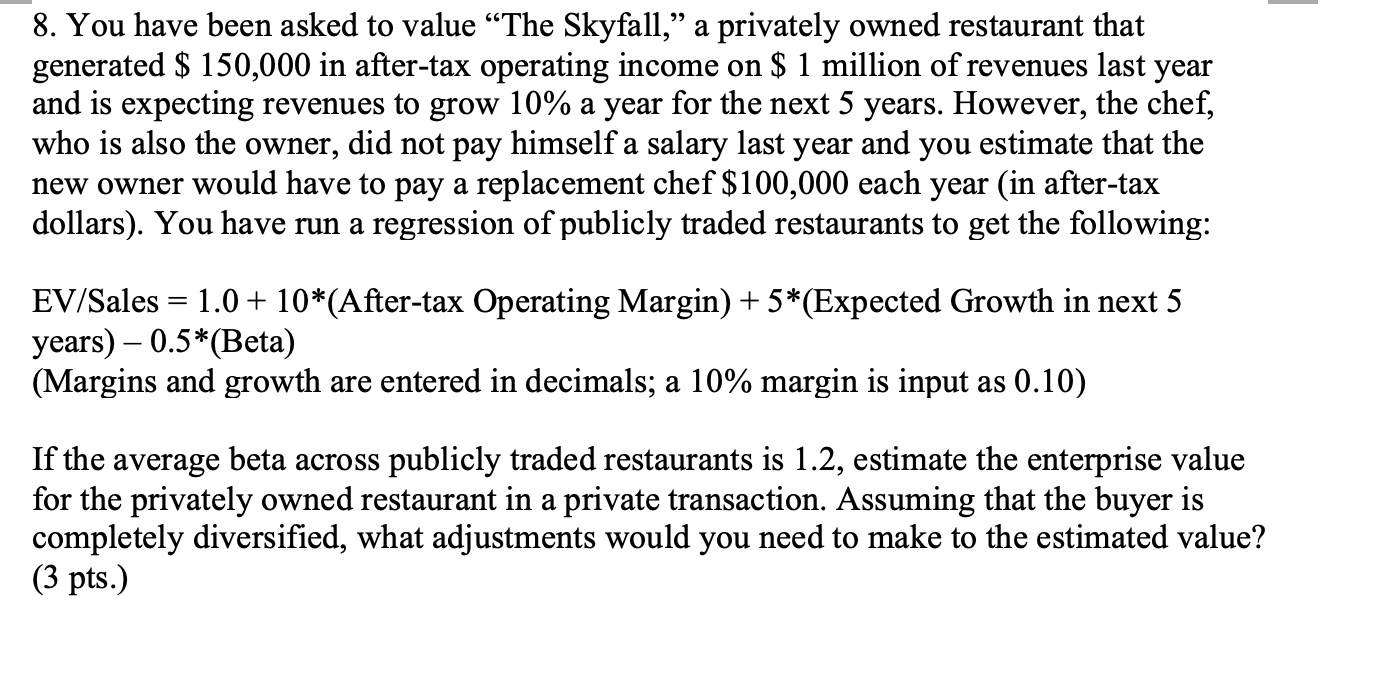

8. You have been asked to value The Skyfall, a privately owned restaurant that generated $ 150,000 in after-tax operating income on $ 1 million of revenues last year and is expecting revenues to grow 10% a year for the next 5 years. However, the chef, who is also the owner, did not pay himself a salary last year and you estimate that the new owner would have to pay a replacement chef $100,000 each year (in after-tax dollars). You have run a regression of publicly traded restaurants to get the following: EV/Sales = 1.0+ 10*(After-tax Operating Margin) + 5*(Expected Growth in next 5 years) 0.5*(Beta) (Margins and growth are entered in decimals; a 10% margin is input as 0.10) If the average beta across publicly traded restaurants is 1.2, estimate the enterprise value for the privately owned restaurant in a private transaction. Assuming that the buyer is completely diversified, what adjustments would you need to make to the estimated value? (3 pts.) 8. You have been asked to value The Skyfall, a privately owned restaurant that generated $ 150,000 in after-tax operating income on $ 1 million of revenues last year and is expecting revenues to grow 10% a year for the next 5 years. However, the chef, who is also the owner, did not pay himself a salary last year and you estimate that the new owner would have to pay a replacement chef $100,000 each year (in after-tax dollars). You have run a regression of publicly traded restaurants to get the following: EV/Sales = 1.0+ 10*(After-tax Operating Margin) + 5*(Expected Growth in next 5 years) 0.5*(Beta) (Margins and growth are entered in decimals; a 10% margin is input as 0.10) If the average beta across publicly traded restaurants is 1.2, estimate the enterprise value for the privately owned restaurant in a private transaction. Assuming that the buyer is completely diversified, what adjustments would you need to make to the estimated value? (3 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts