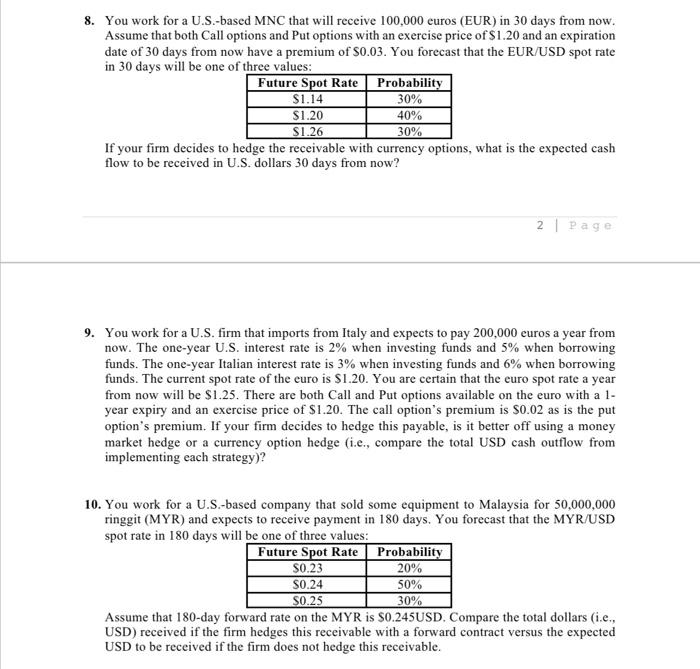

Question: 8. You work for a U.S.-based MNC that will receive 100,000 euros (EUR) in 30 days from now. Assume that both Call options and

8. You work for a U.S.-based MNC that will receive 100,000 euros (EUR) in 30 days from now. Assume that both Call options and Put options with an exercise price of $1.20 and an expiration date of 30 days from now have a premium of $0.03. You forecast that the EUR/USD spot rate in 30 days will be one of three values: Future Spot Rate Probability $1.14 30% 40% 30% If your firm decides to hedge the receivable with currency options, what is the expected cash flow to be received in U.S. dollars 30 days from now? $1.20 $1.26 2 Page 9. You work for a U.S. firm that imports from Italy and expects to pay 200,000 euros a year from now. The one-year U.S. interest rate is 2% when investing funds and 5% when borrowing funds. The one-year Italian interest rate is 3% when investing funds and 6% when borrowing funds. The current spot rate of the euro is $1.20. You are certain that the euro spot rate a year from now will be $1.25. There are both Call and Put options available on the euro with a 1- year expiry and an exercise price of $1.20. The call option's premium is $0.02 as is the put option's premium. If your firm decides to hedge this payable, is it better off using a money market hedge or a currency option hedge (i.e., compare the total USD cash outflow from implementing each strategy)? 10. You work for a U.S.-based company that sold some equipment to Malaysia for 50,000,000 ringgit (MYR) and expects to receive payment in 180 days. You forecast that the MYR/USD spot rate in 180 days will be one of three values: Future Spot Rate Probability $0.23 20% S0.24 $0.25 50% 30% Assume that 180-day forward rate on the MYR is $0.245USD. Compare the total dollars (i.e., USD) received if the firm hedges this receivable with a forward contract versus the expected USD to be received if the firm does not hedge this receivable.

Step by Step Solution

There are 3 Steps involved in it

8 Expected Cash Flow with Currency Options Hedge Using the information providedlets analyze the expe... View full answer

Get step-by-step solutions from verified subject matter experts