Question: 8.1. What is a general distinction between US versus global accounting standards? In comparing traditional GAAP VS IFRS (International Financial Reporting Standards), which set of

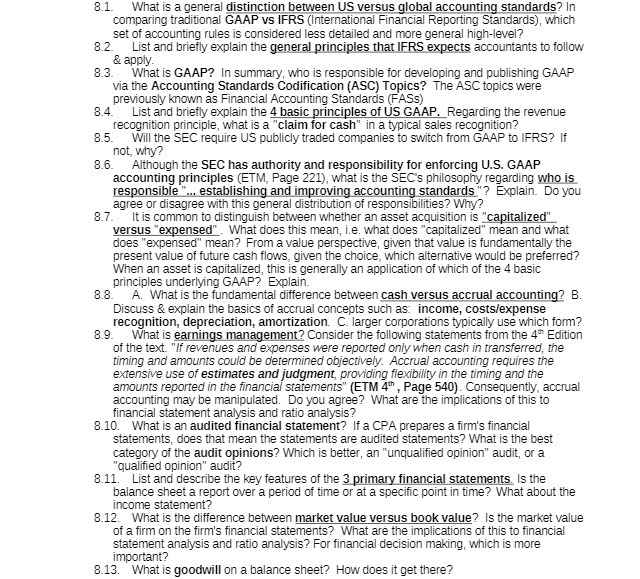

8.1. What is a general distinction between US versus global accounting standards? In comparing traditional GAAP VS IFRS (International Financial Reporting Standards), which set of accounting rules is considered less detailed and more general high-level? 8.2. List and briefly explain the general principles that IFRS expects accountants to follow & apply. 8.3. What is GAAP? In summary, who is responsible for developing and publishing GAAP via the Accounting Standards Codification (ASC) Topics? The ASC topics were previously known as Financial Accounting Standards (FASS) 8.4. List and briefly explain the 4 basic principles of US GAAP. Regarding the revenue recognition principle, what is a "claim for cash" in a typical sales recognition? 8.5. Will the SEC require US publicly traded companies to switch from GAAP to IFRS? If not, why? 8.6. Although the SEC has authority and responsibility for enforcing U.S. GAAP accounting principles (ETM, Page 221), what is the SEC's philosophy regarding who is responsible "... establishing and improving accounting standards "? Explain. Do you agree or disagree with this general distribution of responsibilities? Why? 8.7. It is common to distinguish between whether an asset acquisition is "capitalized" versus "expensed". What does this mean, i.e. what does "capitalized" mean and what does "expensed" mean? From a value perspective, given that value is fundamentally the present value of future cash flows, given the choice, which alternative would be preferred? When an asset is capitalized, this is generally an application of which of the 4 basic principles underlying GAAP? Explain. 8.8. A. What is the fundamental difference between cash versus accrual accounting? B. Discuss & explain the basics of accrual concepts such as: Income, costs/expense recognition, depreciation, amortization. C. larger corporations typically use which form? 8.9. What is earnings management? Consider the following statements from the 4" Edition of the text. "If revenues and expenses were reported only when cash in transferred, the timing and amounts could be determined objectively. Accrual accounting requires the extensive use of estimates and judgment, providing flexibility in the timing and the amounts reported in the financial statements" (ETM 4" , Page 540). Consequently, accrual accounting may be manipulated. Do you agree? What are the implications of this to financial statement analysis and ratio analysis? 8.10. What is an audited financial statement? If a CPA prepares a firm's financial statements, does that mean the statements are audited statements? What is the best category of the audit opinions? Which is better, an "unqualified opinion" audit, or a 'qualified opinion" audit? 8.11. List and describe the key features of the 3 primary financial statements. Is the balance sheet a report over a period of time or at a specific point in time? What about the income statement? 8.12. What is the difference between market value versus book value? Is the market value of a firm on the firm's financial statements? What are the implications of this to financial statement analysis and ratio analysis? For financial decision making, which is more important? 8.13. What is goodwill on a balance sheet? How does it get there

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts