Question: 8-11: Valuing Common Stocks with the Dividend Growth Model Problem 8-21 Nonconstant Growth Stock Valuation Conroy Consulting Corporation (CCC) has been growing at a rate

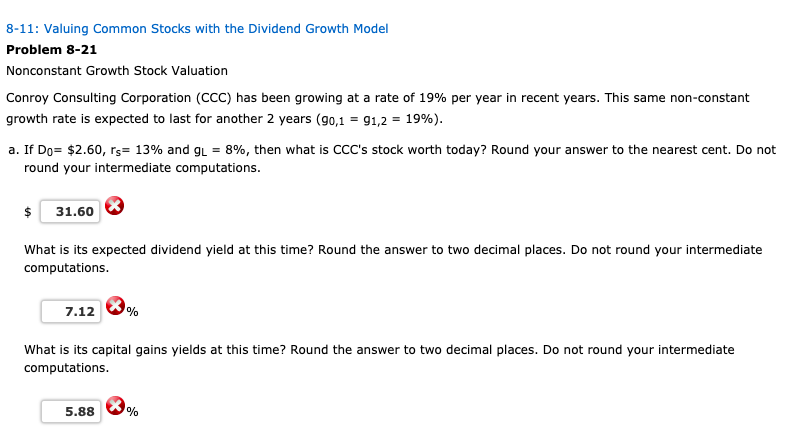

8-11: Valuing Common Stocks with the Dividend Growth Model Problem 8-21 Nonconstant Growth Stock Valuation Conroy Consulting Corporation (CCC) has been growing at a rate of 19% per year in recent years. This same non-constant growth rate is expected to last for another 2 years (90,1 = 91,2 = 19%). a. If Do= $2.60, rs= 13% and gL = 8%, then what is CCC's stock worth today? Round your answer to the nearest cent. Do not round your intermediate computations. $ 31.60 What is its expected dividend yield at this time? Round the answer to two decimal places. Do not round your intermediate computations. 7.12 % What is its capital gains yields at this time? Round the answer to two decimal places. Do not round your intermediate computations. 5.88 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts