Question: 8:13 PM Sun May 7 41% AA Awww-awu.aleks.com C + CWV-101 Calendar x A ALEKS - Anna Stoebe - Topic 5 Homework 5 Topic 5

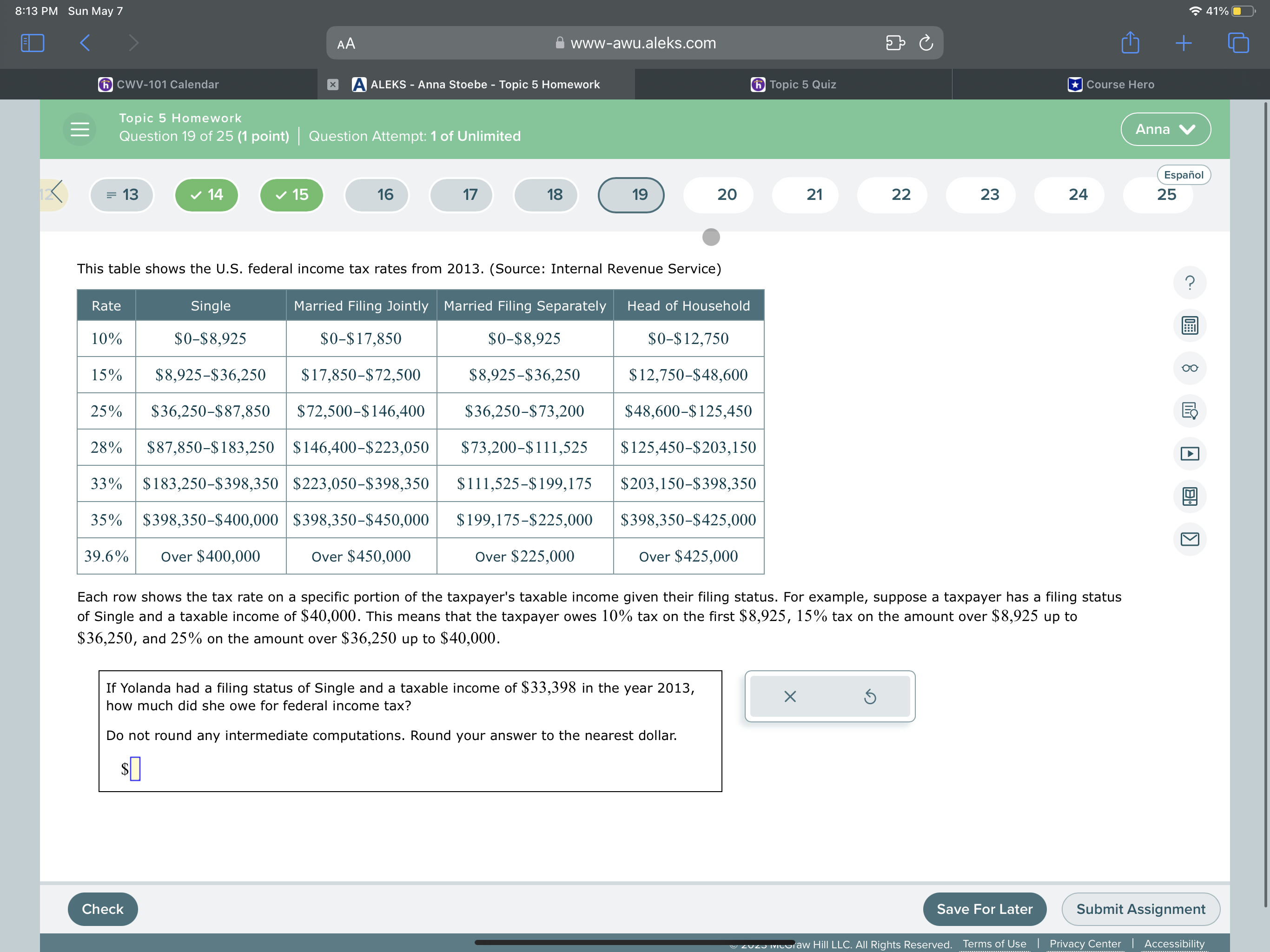

8:13 PM Sun May 7 41% AA Awww-awu.aleks.com C + CWV-101 Calendar x A ALEKS - Anna Stoebe - Topic 5 Homework 5 Topic 5 Quiz Course Hero Topic 5 Homework Question 19 of 25 (1 point) | Question Attempt: 1 of Unlimited Anna V Espanol = 13 14 15 16 17 18 19 20 21 22 23 24 25 This table shows the U.S. federal income tax rates from 2013. (Source: Internal Revenue Service) ? Rate Single Married Filing Jointly |Married Filing Separately Head of Household FEEL 10% $0-$8,925 $0-$17,850 $0-$8,925 $0-$12,750 15% $8,925-$36,250 $17,850-$72,500 $8,925-$36,250 $ 12,750-$48,600 25% $36,250-$87,850 $72,500-$146,400 $36,250-$73,200 $48,600-$125,450 28% $87,850-$183,250 $146,400-$223,050 $73,200-$111,525 $ 125,450-$203,150 33% $183,250-$398,350 $223,050-$398,350 $111,525-$199,175 $203,150-$398,350 35% $398,350-$400,000 $398,350-$450,000 $199,175-$225,000 $398,350-$425,000 39.6% Over $400,000 Over $450,000 Over $225,000 Over $425,000 Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $8,925, 15% tax on the amount over $8,925 up to $36,250, and 25% on the amount over $36,250 up to $40,000. If Yolanda had a filing status of Single and a taxable income of $33,398 in the year 2013, how much did she owe for federal income tax? X Do not round any intermediate computations. Round your answer to the nearest dollar. $ Check Save For Later Submit Assignment All Rights Reserved. Terms of Use | Privacy Center Acce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts