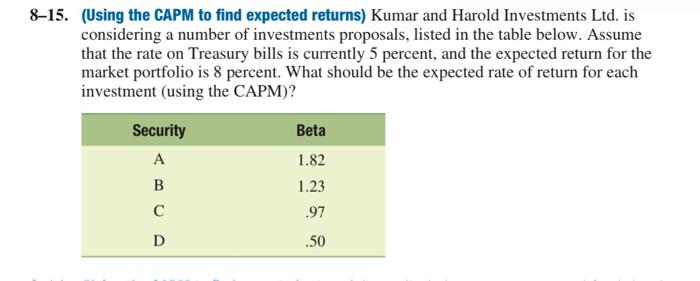

Question: 8-15. (Using the CAPM to find expected returns) Kumar and Harold Investments Ltd. is considering a number of investments proposals, listed in the table below.

not in excel

I need simple formula with all the process

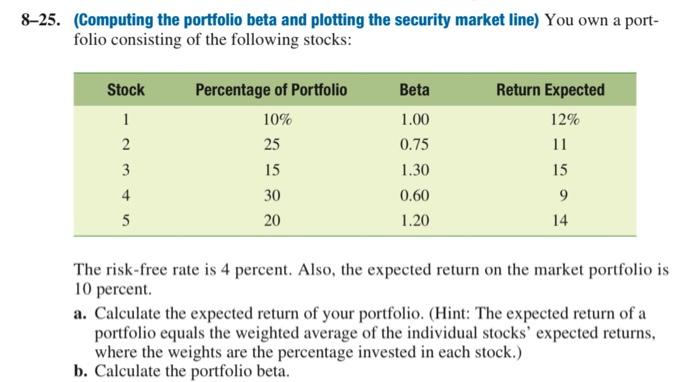

5. (Using the CAPM to find expected returns) Kumar and Harold Investments Ltd. is considering a number of investments proposals, listed in the table below. Assume that the rate on Treasury bills is currently 5 percent, and the expected return for the market portfolio is 8 percent. What should be the expected rate of return for each investment (using the CAPM)? 5. (Computing the portfolio beta and plotting the security market line) You own a portfolio consisting of the following stocks: The risk-free rate is 4 percent. Also, the expected return on the market portfolio is 10 percent. a. Calculate the expected return of your portfolio. (Hint: The expected return of a portfolio equals the weighted average of the individual stocks' expected returns, where the weights are the percentage invested in each stock.) b. Calculate the portfolio beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts